IMARC Group has recently released a new research study titled “North America Peanut Butter Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Country, 2025-2033”, offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

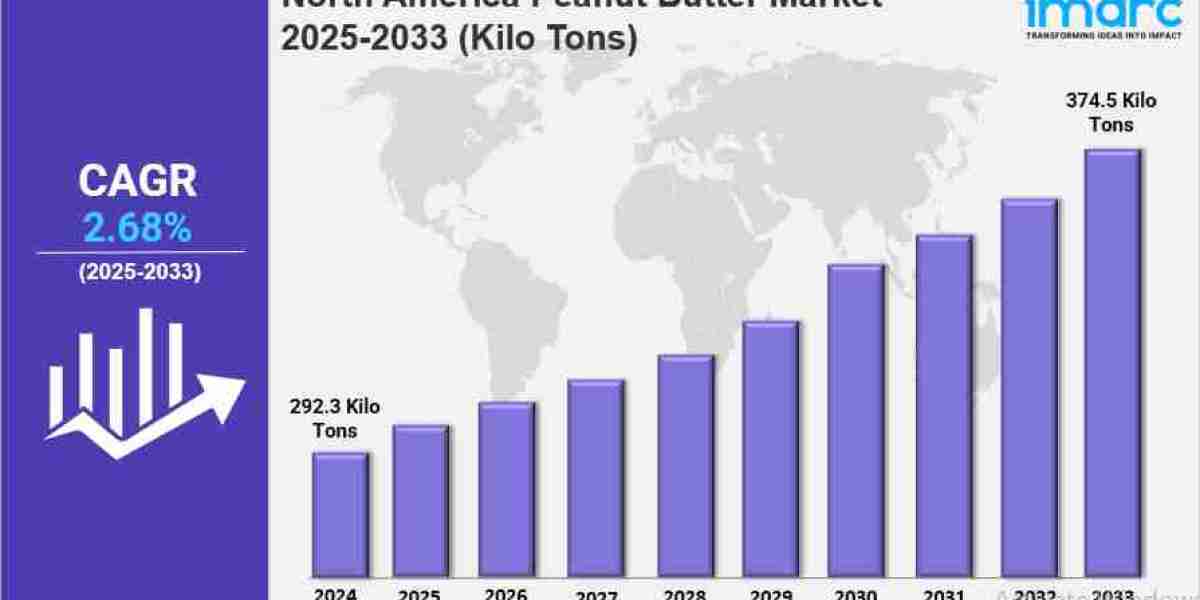

The North America peanut butter market size was valued at 292.3 Kilo Tons in 2024 and is projected to reach 374.5 Kilo Tons by 2033, growing at a CAGR of 2.68% during the forecast period. This growth is driven by rising consumer preference for protein-rich snacks, increasing demand for natural and organic products, and strong brand presence. Innovations in flavors and packaging also propel market expansion.

Study Assumption Years

Base Year: 2024

Historical Year/Period: 2019-2024

Forecast Year/Period: 2025-2033

North America Peanut Butter Market Key Takeaways

Current Market Size: 292.3 Kilo Tons in 2024

CAGR: 2.68% (2025-2033)

Forecast Period: 2025-2033

Market growth is driven by increasing consumer preference for protein-rich, healthy snacks and demand for natural and organic variants.

Innovation in flavors includes honey-roasted, chocolate-infused, and cinnamon-seasoned peanut butters.

Functional peanut butter variants fortified with protein, collagen, probiotics, and superfoods like chia and flaxseeds are gaining popularity.

The rising adoption of plant-based and vegan diets has significantly fueled demand.

North America, especially the United States, leads production and consumption, supported by stable peanut supply and market accessibility.

Sample Request Link: https://www.imarcgroup.com/north-america-peanut-butter-market/requestsample

Market Growth Factors

North America peanut butter market growth is being driven by rising health and nutrition consciousness, as consumers increasingly prefer protein-rich and nutrient-dense food products.Furthermore, peanut butter is a good source of protein, healthy fat, vitamins, and of popularity among fitness freaks and people following plant-based diets. IMARC Group states the U.S organic food market measured US$ 82.7 Billion in 2023 and should expand at a CAGR of 7.47% to measure US$ 158.2 Billion by 2032, which highlights growth of organic and clean-label food products (like peanut butter) on the market.

Consumers demand and that results as developers develop more products without additives, such as hydrogenated oils, sugar and preservatives. These products have only peanuts, or peanuts with sea salt. Organic peanut butter comes from peanuts without GMOs or fungicides. It can meet consumer preferences regarding sustainability and health considerations. Expansion in the e-commerce and direct-to-consumer channels around the world may also encourage market growth for the premium organic peanut butter brands overall in general.

Manufacturers innovate products a chief growth driver. Manufacturers introduce new variants of honey-roasted, chocolate and cinnamon-flavored peanut butter with increasing frequency. New functional peanut butter products with protein, collagen, and probiotics fortify them, along with superfood ingredients such as chia seeds and flaxseeds. These products are popular with health-conscious consumers and fitness junkies. The plant-based diet trend creates a need for protein-rich, varied flavors of peanut butter and opens opportunities to differentiate products and position products.

Market Segmentation

Breakup By Product:

Crunchy Peanut Butter: Contains peanut chunks offering texture and crunch, appealing to consumers who prefer a traditional peanut butter experience.

Smooth Peanut Butter: Creamy and spreadable texture favored due to versatility and appeal to a wider audience including children and older adults. It is a key ingredient in sandwiches, baked goods, protein shakes, and confectionery products.

Others: Includes assorted variants beyond crunchy and smooth types.

Breakup By Distribution Channel:

Supermarkets and Hypermarkets: Dominate due to wide product accessibility, consumer preference for in-store shopping, and competitive pricing with promotional deals and bulk options.

Convenience Stores: Provide quick, easy access though smaller selection.

Online Stores: Growing channel due to e-commerce expansion, offering premium, organic, and specialty peanut butter options.

Others: Include other retail channels not classified above.

Breakup By Country:

United States: Largest market led by major peanut-producing states like Georgia, Texas, and Alabama. The U.S. had a peanut production of 5.57 billion pounds in 2022, with Georgia contributing over half.

Canada: Additional market within North America.

Regional Insights

The United States leads the North America peanut butter market due to its status as one of the world’s largest peanut producers, particularly in Georgia, Texas, and Alabama. In 2022, the USDA reported US peanut production at 5.57 billion pounds, with Georgia producing 2.9 billion pounds, over half of the total output. This strong agricultural base ensures a steady supply of raw materials, stable pricing, and consistent quality. The U.S. is the largest consumer and exporter of peanut butter in the region, driven by high per capita consumption and widespread use in households, schools, and foodservice.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=1766&flag=C

Recent Developments & News

January 2025: Gelgoog completed delivery of its USA peanut butter production line project, marking a significant milestone.

January 2025: Meet Fresh launched new Peanut Butter sweets including shaved ice and warm drinks for Lunar New Year.

January 2025: Purely Elizabeth expanded its cookie granola portfolio with peanut butter cookie granola, contributing to category sales of approximately $1.3 billion with 85% year-over-year growth.

January 2024: Reese’s introduced Direct from the Factory Peanut Butter Eggs, supplying products shortly after production.

May 2024: Jif launched its largest flavor innovation, Jif Peanut Butter & Chocolate Flavored Spread combining creamy peanut butter with chocolate sweetness.

Key Players

Jif

Skippy

Peter Pan

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302