IMARC Group, a leading market research company, has recently released a report titled "Laser Cladding Equipment Market Report by Power (High Power, Low Power), Application (Power Generation, Industrial, Mining, and Others), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global laser cladding equipment market size, share, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Laser Cladding Equipment Market Highlights:

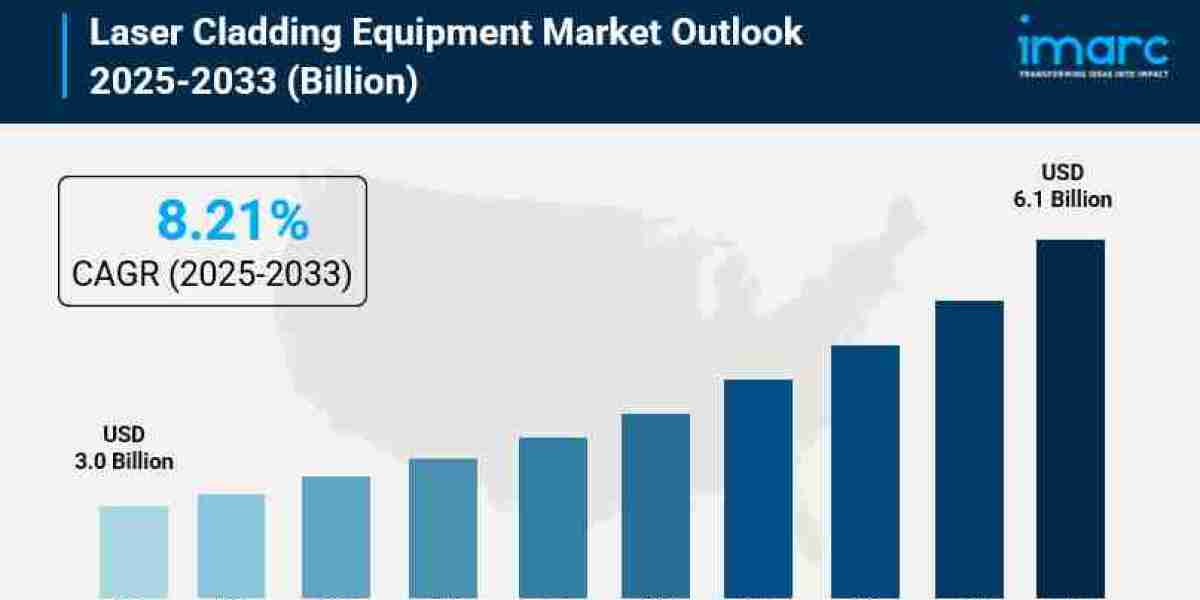

- Laser Cladding Equipment Market Size: Valued at USD 3.0 Billion in 2024.

- Laser Cladding Equipment Market Forecast: The market is expected to reach USD 6.1 billion by 2033, growing at an impressive rate of 8.21% annually.

- Market Growth: The laser cladding equipment market is witnessing robust expansion driven by increasing demand for advanced surface treatment solutions and growing adoption across critical industries.

- Technology Integration: Revolutionary advances in laser technology, including high-power fiber lasers and automated systems, are transforming surface engineering processes.

- Industrial Leadership: The power generation and industrial segments dominate market applications, driven by the need for enhanced wear resistance and component longevity.

- Manufacturing Focus: High-power systems command the largest market share, reflecting demand for rapid deposition rates in industrial applications.

- Key Players: Industry leaders include Coherent Inc., IPG Photonics Corporation, TRUMPF, OC Oerlikon Management AG, and Han's Laser Technology Industry Group, which drive innovation with cutting-edge solutions.

- Market Challenges: High initial equipment costs and the need for skilled operators present ongoing challenges for broader market adoption.

Claim Your Free “Laser Cladding Equipment Market” Insights Sample PDF: https://www.imarcgroup.com/laser-cladding-equipment-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Surging Demand for Advanced Surface Treatment Solutions:

This has led to many industries quickly investing in laser cladding equipment to solve any component life or performance problems. Manufacturing industries, where the machinery has a high value, are now recognizing the process as a way to extend the useful life of machines and reduce replacement costs. More than 40% of companies in the aerospace industry are using laser cladding to extend the service life of components of engines, turbines and other key components. The automotive industry is starting to use these services in relation to engine and transmission components. The metallurgical bonding and material deposition accuracy of this process has enabled it to be readily adopted into many critical applications. The latest machines can accommodate parts with weights up to 6800 kg (15 000 lb) and outside diameters of 244 centimeters (96 in), and the applications span several industries.

- Revolutionary Laser Technology Breakthroughs:

Laser cladding equipment for the process is continuously evolving due to technology developments. High power direct diode lasers (HPDDL) are the latest laser technology being used for heat processing as they have much higher energy efficiency than carbon dioxide or YAG lasers. IPG Photonics Corporation announced its LightWELD 2000 XR in May 2024, a 2 kW portable integrated laser welding and laser cleaning system design. The new laser technology includes a 2000 W laser and a new ultrafast optics lens, offering possibilities for faster processing speeds and thicker workpieces to improve fabrication productivity and process efficiency. In 2024 Han's Laser Technology also released their next-generation carbon dioxide laser cladding system, promising a 31% reduction in power consumption and a 20% reduction in downtime. These innovations are setting new standards in precision, efficiency and cost-effectiveness in industrial surface engineering.

- Massive Industrial Infrastructure Investments:

Different surface treatment manufacturers have also recently invested in new facilities to expand their capabilities. For example, Oerlikon Metco Coating Services has invested in a new laser cladding service center in Huntersville, North Carolina, which, in addition to offering other service capabilities, provides external and internal diameter coatings, laser hardening, pre- and post-machining and inspection. The facility serves the aerospace, energy and automotive markets, with components diameters ranging from 51 cm to 305 cm (20 to 120 in). In January 2024, TRUMPF opened a new manufacturing facility in Pune, India to serve the growing Indian market and expand its international supply chain. The company also invests in research and development with USD 525.7 million in spending to support organic growth. This can be seen in meaningful infrastructure investments as the industry supports the continued growth of the market and supports laser cladding as a core manufacturing technology.

- Automation and Industry 4.0 Integration:

The combination of artificial intelligence and Internet of Things technologies with laser cladding systems opens excellent perspectives. Smart sensors can be used in cladding processes to provide real-time information about the temperature, the deposition rate and the material flow. Data analysis is supported by AI algorithms and as a result manufacturers can predict equipment failures and optimize process parameters. In 2023, IPG Photonics launched a diode laser-based cladding module for applications that require a high level of automation. The manufacturer said that the new product increases process automation by 28%, increases repair precision, and improves uniformity of coating thickness by 23% on aerospace turbine disks and compressor housings. Automation of production tasks is estimated to account for a quarter of the current market for laser cladding. Smart industries report a 24% reduction in maintenance downtime.

Laser Cladding Equipment Market Report Segmentation:

Breakup by Power:

- High Power

- Low Power

High power systems dominate the market, representing the majority of installations due to their suitability for industrial applications requiring high deposition rates and rapid turnaround times.

Breakup by Application:

- Power Generation

- Industrial

- Mining

- Others

Power generation leads market applications, driven by the escalating need for wear and corrosion resistance in turbines and critical components, with a strong focus on extending equipment lifespan and reducing maintenance costs.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- ALPHA LASER GmbH

- Dura-Metal (S) Pte. Ltd.

- IPG Photonics Corp.

- Meera Lasers Solution Pvt. Ltd.

- Preco LLC

- SprayWerx Technologies Inc.

- TLM Laser Ltd.

- Trumpf Group

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=12267&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302