IMARC Group, a leading market research company, has recently released a report titled "Battery Materials Market Size, Share, Trends and Forecast by Type, End Use Sector, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global battery materials market Trends, size, share, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Battery Materials Market Highlights:

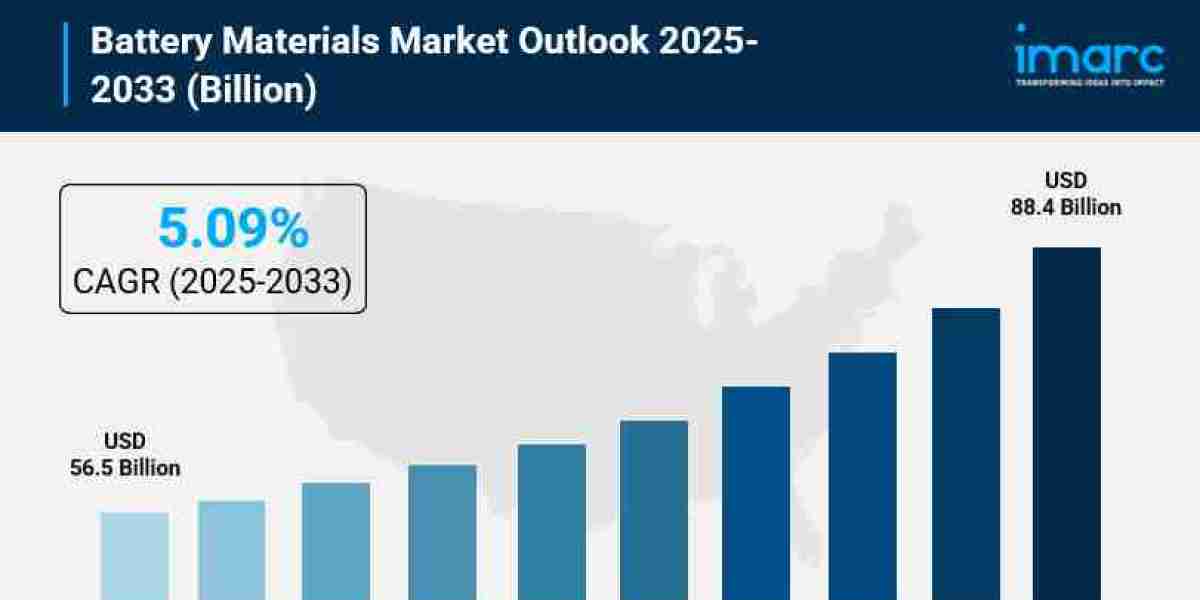

- Battery Materials Market Size: Valued at USD 56.5 Billion in 2024.

- Battery Materials Market Forecast: The market is expected to reach USD 88.4 billion by 2033, exhibiting a growth rate of 5.09% during 2025-2033.

- Market Growth: The battery materials market is experiencing robust growth driven by explosive electric vehicle adoption and the global shift toward renewable energy storage solutions.

- Technology Integration: Advanced cathode chemistries, solid-state battery technologies, and innovative anode materials are revolutionizing energy density and charging capabilities.

- Regional Leadership: Asia Pacific commands the largest market share, fueled by China, Japan, and South Korea's dominance in lithium-ion battery manufacturing and raw material supply.

- Sustainability Focus: Battery recycling and circular economy initiatives are gaining momentum, with recycling potentially supplying 20-30% of global lithium, nickel, and cobalt demand by mid-century.

- Key Players: Industry leaders include Albemarle Corporation, BASF SE, Umicore N.V., Livent, Mitsubishi Chemical Holdings Corporation, and Asahi Kasei Corporation, which dominate the market with innovative material solutions.

- Market Challenges: Geopolitical concentration of critical minerals, supply chain dependencies, and ethical sourcing concerns present ongoing challenges for global battery manufacturers.

Claim Your Free “Battery Materials Market” Insights Sample PDF: https://www.imarcgroup.com/battery-materials-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Electric Vehicle Adoption:

The automotive industry is undergoing its biggest transformation for 100 years. Once seen as niche products, electric vehicles (EVs) have achieved a tipping point, with sales of more than 17 million vehicles, or 20 percent of total global car sales. This tremendous growth is supported by the extreme growth of battery materials. Seventeen point one million new electric cars faced sales worldwide in 2024 after a twenty-five percent increase from 2023. Electric vehicle sales increase due to battery technology advances, charging infrastructure investment, and government incentives, which indicates likely continued momentum. During 2024, EV sales increased 25% to 17 million. This increase created a demand of over 1 TWh each year for batteries for the first time. However, these sales did not distribute evenly worldwide as China produced 80% of global battery cell production in 2024 for EV applications. Affordability remains a barrier for EV adoption, with roughly 60% of 2021 EV sales in China made at a price lower than ICE vehicles. But with the rapid speed of EV adoption, there is enormous demand for the primary battery materials lithium, nickel, cobalt, and graphite; battery materials are becoming one of the world's most important commodity markets.

- Revolutionary Government Initiatives Reshaping Supply Chains:

One feature of this trend has been the recognition by governments around the world of battery materials as a matter of national security and economic competitiveness, and an unprecedented policy push and investment in the sector. The US Department of Energy awarded 25 projects with more than $3 billion from the bipartisan infrastructure law to expand US production of advanced batteries and battery materials. DOE announced more than $3 billion in funding for 25 projects across 14 states to increase US production of advanced batteries and battery materials. The projects are projected to create over 8000 construction jobs and over 4000 operating jobs. In addition, billions of dollars from loan programs and tax credits are being spent, with nearly $100 billion in private sector investments going into the clean vehicle and battery supply chain from the Inflation Reduction Act alone since it was signed into law. Battery components for clean vehicle tax credits shift from 60 to 100 per cent domestic or from free trade agreement partners by 2030. The Department of Defense has taken action to address calculated shortages in supply chains for critical materials, as batteries are essential to military readiness, by invoking the Defense Production Act (DPA) to stimulate domestic production. So when it comes to battery materials, from Energy to Defense to Treasury, you see how much of a planned priority this is.

- Breakthrough Innovations in Battery Chemistry and Recycling:

The battery materials industry currently experiences a technological renaissance. In July 2025, BASF and CATL agreed to a framework to develop and supply cathode active materials to enable next-generation battery technology. This partnership works to combine two industry leaders' efforts for innovation at an incredible pace. BASF's joint venture with Nio, which produces cathode materials for semi-solid state batteries, delivered its first mass production of such materials to Beijing Welion New Energy Technology. The factory went from concept to mass production in under a year (August 2024). These are not incremental innovations; these are game changers. The NCM cathode active materials are ultra-high nickel with proprietary composite coating layers, specifically designed to address cathode material/solid electrolyte interface issues and improve energy density and cycle life. Recycling has similar potential. In 2024, the value of the global EV battery recycling market was USD 2.6 billion; this should reach USD 22.2 billion in 2032; the compound annual growth rate is 24.9%. In 2020 battery recyclers worldwide recycled an estimated 250 kilotons in total nameplates, which people expect to increase to more than 1.7 million tons through 2030 and over 20 million tons during 2040. In November 2023, BASF announced that it signed a memorandum for understanding with South Korea's SK On to explore collaboration in the global lithium-ion battery recycling business within North America and the Asia-Pacific region. These alliances could greatly reduce mining requirements through closed-loop supply chains.

- Surging Demand from Renewable Energy Storage Systems

A parallel green energy transition is driving structural demand at a similar scale and speed as in the automotive sector. Countries are racing to meet climate targets while renewable energy installations are being deployed at a record pace. Intermittency is a general problem for renewables: solar cells do not produce electricity at night, and wind turbines only produce electricity when there is wind. Consequently, there is a large interest in grid-scale batteries to store excess renewable energy and supply energy on demand. Global battery cell manufacturing capacity grew by almost 30% in 2024 to over 3 TWh, three times greater than demand from electric vehicles and stationary battery storage. The transportation and stationary storage markets are leading the battery industry to meet this demand as battery companies around the world ramp up capacity. Energy companies are developing advanced materials for batteries to make the grids stronger and to make them less dependent on fossil fuels. The increasing share of renewable energy on the electrical grids of many countries is accelerating the need for advanced batteries that respond quickly, have many cycles and a long life. Key to this trend are, first of all, the policies implemented to promote it, such as rebates and infrastructure investments. Battery materials have a dual-use. Improvements in automotive batteries can often transfer to stationary storages and stationary storage improvements can transfer to automotive batteries. This leads to a virtuous cycle. Advances in one technology can benefit the other.

Battery Materials Market Report Segmentation:

Breakup by Type:

- Cathode

- Anode

- Electrolyte

- Separator

- Others

Cathode dominates the market, playing a crucial role in determining battery performance, capacity, and lifespan, with materials like lithium, nickel, cobalt, and manganese directly influencing energy density and power output.

Breakup by Battery Type:

- Lithium Ion

- Lead Acid

- Others

Lithium ion holds the largest share in the market due to its widespread use in electric vehicles, consumer electronics, and renewable energy storage applications, known for high energy density, lightness, and longer cycle life.

Breakup by Application:

- Automobile Industry

- Household Appliances

- Electronics Industry

- Others

Automobile industry holds the maximum share in the market due to the increasing adoption of electric vehicles and hybrid cars, driven by global efforts to reduce carbon emissions and stringent environmental regulations.

Breakup by Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the global market, supported by stringent regulatory requirements, widespread technology adoption, sophisticated emergency response infrastructure, and heightened security awareness.

Who are the key players operating in the industry?

The report covers the major market players including:

- Albemarle Corporation

- Asahi Kasei Corporation

- BASF SE

- Entek International Ltd.

- Johnson Matthey

- Livent

- Mitsubishi Chemical Holdings Corporation

- Nichia Corporation

- Showa Denko K. K.

- Sumitomo Chemical Co. Ltd.

- Targray Technology International Inc.

- Umicore N.V.

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=5478&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302