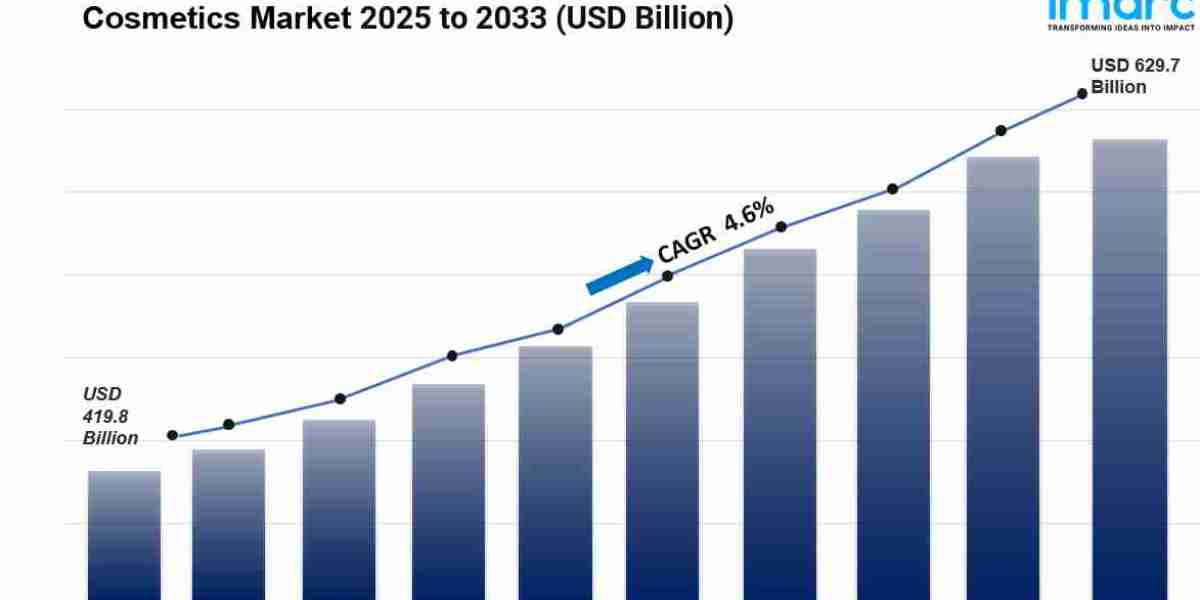

The global cosmetics market size was valued at USD 419.8 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 629.7 Billion by 2033, exhibiting a CAGR of 4.6% during 2025-2033. North America currently dominates the market, holding a significant market share in 2024. The market is experiencing steady growth driven by the growing emphasis on personal grooming, the introduction of advanced product variants, the escalating demand for vegan cosmetics, and the rising product availability on e-commerce platforms.

Key Stats for Cosmetics Market:

- Cosmetics Market Value (2024): USD 419.8 Billion

- Cosmetics Market Value (2033): USD 629.7 Billion

- Cosmetics Market Forecast CAGR: 4.6%

- Leading Segment in Cosmetics Market in 2024: Skin and Sun Care Products

- Key Regions in Cosmetics Market: Asia Pacific, Europe, North America, Latin America, Middle East and Africa

- Top companies in Cosmetics Market: Amway Corp., Avon Products Inc. (Natura & Co), Beiersdorf AG, Henkel AG & Co. KGaA, Kao Corporation, L'Oréal SA, Oriflame Cosmetics AG, Revlon Inc., Shiseido Company Limited, Skinfood Co. Ltd, The Estée Lauder Companies Inc., The Procter & Gamble Company, Unilever PLC, etc.

Why is the Cosmetics Market Growing?

The cosmetics market is expanding rapidly as beauty and personal care become central to everyday routines worldwide, with strong competition influencing the overall Cosmetics Market Share. What’s fueling this growth? It’s a mix of changing consumer expectations, technological innovation, and a fundamental shift in how people approach self-care.

Today's consumers are far more informed than they were a decade ago. They're reading ingredient labels, researching brands online, and actively seeking products that align with their values. Health consciousness has moved beyond fitness and nutrition—it now extends to what people put on their skin. This awareness has created massive demand for natural, organic, and clean beauty products. Consumers are concerned about synthetic chemicals, potential allergens, and long-term health impacts, pushing brands to reformulate products with safer, more transparent ingredients.

The rise of working women globally has significantly impacted market dynamics. According to financial comparison service provider Mozo, the average Australian woman spends approximately USD 3,600 on beauty and personal care products annually. This pattern repeats across developed markets, reflecting both purchasing power and the importance placed on professional appearance and personal grooming. In many cultures, cosmetics have transitioned from luxury items to everyday essentials.

E-commerce has fundamentally changed how people discover and buy cosmetics. Geographic barriers have essentially disappeared—consumers can now access niche Korean skincare brands, French luxury perfumes, or American organic makeup lines regardless of where they live. Online platforms provide detailed product information, customer reviews, and how-to tutorials that educate consumers and build confidence in purchasing. India's Nykaa and Sephora's global online presence exemplify this trend, offering thousands of products with next-day delivery in major cities.

Brands are responding to diverse consumer needs by introducing advanced product variants. L'Oréal Paris recently launched its Glycolic Bright Day Cream with SPF 17, targeting dark spots while providing UV protection. The Body Shop introduced its 'activist' product range in India, featuring sustainable skin products and color cosmetics. These innovations aren't just marketing gimmicks—they represent genuine R&D investments addressing specific consumer concerns like aging, acne, hyperpigmentation, and sensitivity.

Request for a sample copy of this report: https://www.imarcgroup.com/cosmetics-market/requestsample

AI Impact on the Cosmetics Market:

Artificial intelligence is fundamentally transforming how cosmetics brands develop products, engage customers, and drive sales. The AI in beauty and cosmetics market itself is experiencing explosive growth, valued at USD 4.43 Billion in 2024 and projected to grow substantially in coming years.

AI's most visible impact is in personalization. Leading brands like L'Oréal, Neutrogena, and Olay are using facial recognition, skin tone and type analysis, and hair color and texture assessments to provide customized product recommendations. Virtual try-on technologies have become standard features on e-commerce platforms, allowing customers to see how lipstick shades, eyeshadow colors, or foundation tones will look on their skin before purchasing. This technology dramatically reduces purchase hesitation and return rates.

Behind the scenes, AI is revolutionizing product development. Brands are analyzing massive datasets to identify emerging trends, understand customer preferences, and predict which product attributes will resonate with specific demographics. PROVEN Skincare, for example, has invested heavily in AI innovation to develop personalized skincare formulations based on individual skin profiles. In April 2022, Shiseido revealed Ulé, a new skincare brand that sources pesticide-free botanicals from local vertical farms—a decision informed by AI analysis of consumer preferences for clean, sustainable ingredients.

Chatbots and virtual assistants powered by AI provide real-time customer support, answering questions about product ingredients, usage instructions, and compatibility. Smart mirrors in retail stores use AI to analyze skin conditions and recommend targeted treatments. At-home skin analysis devices can now evaluate skin quality, moisture levels, and problem areas, providing professional-grade diagnostics previously available only at dermatology clinics.

Generative AI is opening new frontiers. Brands are using it for hyperpersonalized marketing, rapid packaging concept development, and innovative product formulation. McKinsey identifies these as high-impact use cases likely to shape the industry through 2025 and beyond. Marketing campaigns can now be tailored to individual consumers based on their browsing history, purchase patterns, and social media engagement.

AI also enhances operational efficiency. Predictive analytics help brands forecast demand, optimize inventory management, and streamline supply chains. Content management systems use AI to generate product descriptions, social media posts, and email campaigns at scale, maintaining consistent brand voice while addressing diverse audience segments.

The experiential aspect of beauty retail is being enhanced through augmented reality powered by AI. Customers can virtually experiment with bold makeup looks they might not dare to try in person, discovering products they wouldn't have considered otherwise. This exploratory behavior drives sales while building brand engagement and loyalty.

Segmental Analysis:

Analysis by Product Type:

- Skin and Sun Care Products

- Hair Care Products

- Deodorants and Fragrances

- Makeup and Color Cosmetics

- Others

Skin and sun care products lead the market as consumers become increasingly aware of proper skincare routines and sun protection importance. Leading brands are investing heavily in research to develop advanced sun protection formulations. The growing popularity of destination travel and beach vacations significantly contributes to demand in this segment.

Analysis by Category:

- Conventional

- Organic

Conventional products lead the market in 2024, benefiting from established consumer trust built over years. These products have well-developed distribution networks and are widely available and easily accessible. However, organic products are growing rapidly as consumers shift toward natural formulations.

Analysis by Gender:

- Men

- Women

- Unisex

Women dominate the market, with the segment accounting for over 62% of market share. The cosmetics market offers a vast array of products specifically targeted toward women, ranging from skincare and makeup to haircare and fragrances. The rising working-women population across the globe significantly contributes to growth in this segment. Brands are increasingly targeting women across light to deep skin tones to promote inclusivity—Lakme Cosmetics launched new lipstick shades specifically suitable for Indian skin tones, including Lakme Absolute Matte Revolution Lip Color in blushing red, cheek color-nude, and MP18 Plum Pick.

Analysis by Distribution Channel:

- Supermarkets and Hypermarkets

- Specialty Stores

- Pharmacies

- Online Stores

- Others

Supermarkets and hypermarkets lead the market in 2024, offering consumers the convenience of finding a wide range of products in one location. British supermarkets have been elevating their beauty offerings—Sainsbury introduced serum bars across 106 stores this summer. These retailers offer competitive pricing due to their ability to negotiate bulk purchasing and pass cost savings to consumers. However, online stores are experiencing the fastest growth, with e-commerce cosmetics sales increasing by 45% in 2023 according to industry data.

Analysis of Cosmetics Market by Regions

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

North America leads the market, driven by high smartphone penetration, a fitness-conscious population, and strong digital infrastructure. The region is home to a sizable consumer population with high disposable income, contributing to increased spending on cosmetic products.

United States: The United States is the largest cosmetics market globally, with approximately 70% of the population using cosmetics daily. In 2023, the market stood at USD 80 Billion, with skincare being the biggest category. More than 3,000 companies operate in the market, including giants like Estée Lauder and L'Oréal USA. Clean beauty and green packaging are increasingly important—around 25% of customers specifically seek these attributes. E-commerce accounted for 45% of cosmetics sales in 2023. L'Oreal invested USD 3.04 Billion in advertising in the United States in 2022 alone, demonstrating the intense marketing focus in this market.

Europe: Europe remains a global leader, valued at approximately USD 105.6 Billion in retail sales in 2023. According to Cosmetics Europe, Germany leads at USD 17.5 billion, followed by France at USD 15.1 Billion and Italy at USD 13.8 Billion. The industry contributes USD 31.9 Billion annually to socio-economic impact, with manufacturing contributing USD 12.1 billion and the supply chain USD 19.8 Billion. More than 3.5 million jobs are directly and indirectly supported, with 259,244 people directly employed in 2023. European consumers—500 million strong—use cosmetics daily with high penetration rates. The region invests around 5% of annual turnover in R&D, amounting to USD 2.6 billion, driving innovation in functional and sustainable products.

Asia Pacific: Asia Pacific is the fastest-growing market, driven by increased disposable incomes and a beauty-conscious population. Approximately 55% of the population uses cosmetics regularly, and the market was valued at USD 120 billion in 2023. China leads the region, accounting for 40% of sales, followed by Japan and South Korea. The "K-beauty" trend, characterized by innovative skincare products, significantly impacts global markets. The region contains more than 7,000 cosmetic companies, including major names like Shiseido and Amorepacific. E-commerce grew 60% in 2023, supported by platforms like Tmall and Lazada. Government initiatives like China's "Made in China 2025" are investing in local production and exports.

Latin America: Latin America shows strong growth driven by urbanization and beauty's cultural emphasis. The Brazilian Association of the Cosmetic Industry estimates that 80% of women and 40% of men apply cosmetics regularly. Brazil represents the largest market, valued at USD 30 billion in 2023, exceeding 50% of the regional industry. With 1,500 companies, including Natura & Co, the market is competitive. E-commerce sales rose by 35% in 2023, with platforms like MercadoLibre supporting growth. Government tax incentives for local manufacturing are helping improve the industry.

Middle East and Africa: This market is expanding with increased consumer spending and cultural changes. Reports indicate that 45% of women and 20% of men use cosmetics daily, with the market valued at USD 35 billion in 2023. The region has approximately 800 companies, including international and local brands like Mikyajy. Premium and halal products are in high demand, contributing to 40% of sales in 2023. Government initiatives like Saudi Vision 2030 are promoting local manufacturing and investment in cosmetics production. The region's young population and growing interest in grooming products contribute to steady market growth.

Request Customization: https://www.imarcgroup.com/request?type=report&id=4418&flag=E

What are the Drivers, Restraints, and Key Trends of the Cosmetics Market?

Market Drivers:

The cosmetics market is propelled by several converging factors. Smartphone and wearable adoption has made beauty content and shopping more accessible than ever—tutorials, reviews, and direct purchasing are just taps away. Rising health awareness extends to skincare and cosmetics, with consumers viewing these products as integral to overall wellness rather than mere vanity.

Personalized fitness solutions are driving demand—just as people want customized workout plans, they want skincare routines tailored to their specific concerns. Home workouts and self-care routines, accelerated by busy lifestyles and hybrid work models, have increased at-home beauty regimen adoption. Integration of features like product tracking, skin analysis, and virtual consultations makes cosmetics shopping more engaging.

The younger demographic's preference for digital solutions is reshaping the market. Millennials and Gen Z are comfortable researching products online, trusting influencer recommendations, and purchasing based on social media content. Subscription-based models offering curated product boxes have gained popularity, providing discovery and convenience.

The increasing working women population globally means more consumers with disposable income prioritizing appearance for professional and personal reasons. Corporate environments often emphasize polished presentation, driving consistent cosmetics consumption.

Market Restraints:

Despite strong growth, the market faces meaningful challenges. Data privacy and security concerns arise as cosmetics apps and smart devices collect sensitive health and personal information. Consumers are increasingly wary about how their facial recognition data, skin analysis results, and purchase histories are stored and used.

Limited internet access or smartphone penetration in developing regions restricts adoption of digital beauty solutions and e-commerce platforms. While urban centers enjoy robust connectivity, rural areas often lack infrastructure for online shopping and digital engagement.

Intense competition among free and paid apps affects profitability for smaller developers and niche brands. Established players with massive marketing budgets dominate consumer attention, making it difficult for innovative startups to gain traction without significant investment.

Lack of physical supervision in app-based consultations or at-home skin analysis raises concerns about improper product usage and safety. Professional dermatologists and beauticians provide expertise that algorithms can't fully replicate, potentially leading to adverse reactions or ineffective treatments when consumers rely solely on digital guidance.

Counterfeit products represent a persistent problem, particularly in e-commerce channels. Fake cosmetics not only erode brand value but pose serious health risks when they contain harmful ingredients or contaminants.

Market Key Trends:

Several trends are reshaping the cosmetics landscape. Artificial intelligence and machine learning are enabling personalized product recommendations and progress tracking that adapt to individual needs over time. Integration with wearables and IoT devices enhances real-time health monitoring—imagine a smart mirror that tracks how your skin responds to different products and environmental conditions.

Hybrid fitness and beauty models combining digital tools with in-person experiences are gaining traction. Virtual consultations followed by in-store product collection or professional treatments represent the best of both worlds—convenience plus expertise.

Gamification features, social community engagement, and challenges are becoming essential for user motivation and retention. Brands are creating loyalty programs that reward consistent engagement, user-generated content, and friend referrals. These social elements transform cosmetics shopping from a solitary activity into a shared experience.

Rising interest in holistic wellness is expanding cosmetics beyond appearance. Products now address stress management, sleep quality, and mental wellness alongside traditional beauty concerns. Brands are positioning themselves as lifestyle partners rather than mere product suppliers.

Sustainability has moved from niche concern to mainstream expectation. Refillable packaging, carbon-neutral shipping, and transparent supply chains are increasingly standard rather than premium features. Consumers—particularly younger ones—are willing to pay more for brands demonstrating genuine environmental commitment.

Inclusivity continues evolving beyond tokenism. Brands are expanding shade ranges, featuring diverse models, and developing products for previously underserved demographics. This isn't just social responsibility—it's smart business recognizing that beauty standards and needs vary widely across cultures and individuals.

Leading Players of Cosmetics Market:

According to IMARC Group's latest analysis, prominent companies shaping the global cosmetics landscape include:

- Amway Corp.

- Avon Products Inc. (Natura & Co)

- Beiersdorf AG

- Henkel AG & Co. KGaA

- Kao Corporation

- L'Oréal SA

- Oriflame Cosmetics AG

- Revlon Inc.

- Shiseido Company Limited

- Skinfood Co. Ltd

- The Estée Lauder Companies Inc.

- The Procter & Gamble Company

- Unilever PLC

These leading providers are expanding their footprint through strategic partnerships, innovative product portfolios, and advanced digital platforms to meet growing consumer demands for personalized, sustainable, and technologically advanced beauty solutions.

Key Developments in Cosmetics Market:

- April 2022: Shiseido revealed Ulé, a new skincare brand that sources pesticide-free botanicals from local vertical farms. This launch reflects growing consumer demand for clean, sustainable ingredients and transparent sourcing practices.

- April 2023: The Body Shop launched its 'activist' product range in the Indian market. The new line strengthens the brand's sustainability commitment with a selection of skin products and color cosmetics, appealing to environmentally conscious consumers.

- June 2023: Rare Beauty by Selena Gomez launched at Sephora India, now available nationwide across all 26 Sephora stores and online at Sephora.nnnow.com. The brand emphasizes inclusive shade ranges and accessible luxury beauty.

- 2023: Nykaa, India's leading beauty and fashion destination, opened doors to the high-performing range of Natasha Moor Cosmetics, expanding its portfolio of international brands available to Indian consumers.

- 2023: Clarins launched UV Plus Multi-Protection Moisturizing Screen SPF 50 that protects against five pollutants encountered in everyday life: atmospheric pollution, blue light, pollen, photopollution, and indoor pollution. This innovation addresses modern urban environmental challenges.

- 2023: Derma Co introduced its Ultra-Light Zinc Mineral Sunscreen in India, providing dermatologist-backed sun protection suitable for tropical climates.

- 2023: Lakme Cosmetics launched new lipstick shades suitable for Indian skin tones, including Lakme Absolute Matte Revolution Lip Color in blushing red, cheek color-nude, and MP18 Plum Pick, promoting inclusivity in color cosmetics.

- Recent: L'Oréal Paris launched Glycolic Bright Day Cream with SPF 17, which aims to reduce dark spots and shield skin from harmful UV rays to unveil bright skin, targeting specific skincare concerns.

- Recent: L'Oréal Groupe launched Perso, a 6.5-inch beauty tech device that delivers personalized on-the-spot skincare and cosmetic formulas. It harnesses artificial intelligence and optimizes personalization over time as the system gathers more data about customers' skin and preferences.

- Recent: Sainsbury introduced serum bars across 106 stores, elevating the beauty offer in British supermarkets and transforming them into more credible beauty retail destinations for consumers.

- Ongoing: PROVEN Skincare launched a Regulation A+ offering to invest in the company's further AI innovation and talent, expand domestic and global marketing strategies for its existing product line, and invest in research and development of new product lines.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=4418&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302