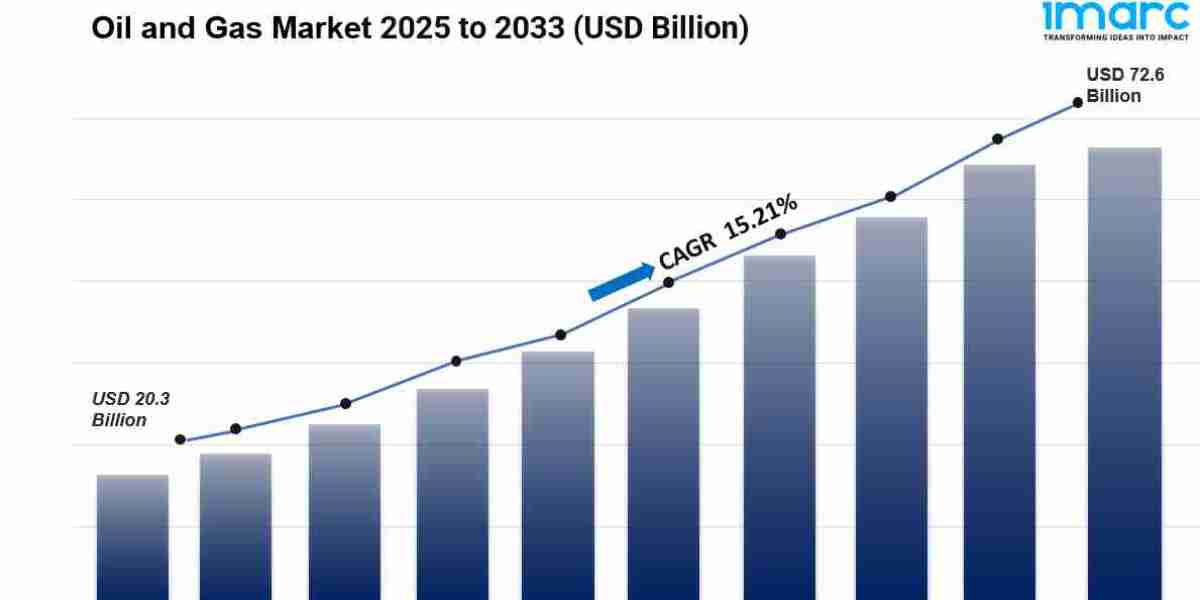

The global oil and gas market size was valued at USD 20.3 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 72.6 Billion by 2033, exhibiting a CAGR of 15.21% during 2025-2033. Asia Pacific currently dominates the market, holding a significant market share of over 36.8% in 2024. The market is experiencing steady growth driven by increasing global energy demand, industrialization, extraction technologies, exploration investments, geopolitical influences, cleaner fuel shifts, and economic recovery that supports the demand in the natural gas and LNG sectors.

Key Stats for Oil and Gas Market:

- Oil and Gas Market Value (2024): USD 20.3 Billion

- Oil and Gas Market Value (2033): USD 72.6 Billion

- Oil and Gas Market Forecast CAGR: 15.21%

- Leading Segment in Oil and Gas Market in 2024: Upstream (49.8%)

- Key Regions in Oil and Gas Market: Asia Pacific, Europe, North America, Latin America, Middle East and Africa

- Top companies in Oil and Gas Market: Bechtel Corporation, Fluor Corporation, HD Hyundai Heavy Industries Co., Ltd, John Wood Group PLC, KBR Inc., Larsen & Toubro Limited, McDermott, NMDC Group, Petrofac Limited, Saipem SpA (Eni S.p.A.), Samsung E&A, TechnipFMC plc, Técnicas Reunidas S.A., Worley, etc.

Request to Get the Sample Report: https://www.imarcgroup.com/oil-gas-market/requestsample

Why is the Oil and Gas Market Growing?

The oil and gas market is experiencing remarkable growth as global energy demands surge alongside rapid industrialization and technological breakthroughs that are reshaping how we extract and utilize fossil fuels. This isn't just about traditional drilling anymore – it's about sophisticated technologies, geopolitical dynamics, and the complex transition toward cleaner energy sources that's creating unprecedented opportunities.

Rapid industrialization across developing nations, particularly in Asia, is driving massive energy consumption growth. Countries like China and India are experiencing unprecedented industrial expansion that requires enormous amounts of energy to power manufacturing, transportation, and urban development. Total energy consumption in India alone grew 5% in 2023, reaching 1.14 Gtoe, reflecting the enormous appetite for energy resources in emerging economies.

Technological innovation has revolutionized the industry landscape. Advanced extraction techniques like hydraulic fracturing and horizontal drilling have unlocked previously inaccessible reserves, transforming countries like the United States into major energy exporters. The U.S. produced 21.91 million barrels of oil per day in 2023, largely thanks to these technological advances that made shale oil and gas production economically viable. These technologies have expanded the global resource base significantly, creating new supply sources and changing international energy dynamics.

The liquefied natural gas (LNG) sector is experiencing particularly strong growth as countries seek cleaner alternatives to coal while maintaining energy security. Natural gas serves as a crucial transitional fuel in the global shift toward sustainability, offering lower emissions than coal while providing reliable baseload power. This has created robust demand from Asia Pacific and Europe, where energy security concerns and environmental regulations are driving LNG imports.

Geopolitical factors continue to reshape market dynamics, with energy security becoming a critical national priority. Supply chain disruptions, sanctions, and regional conflicts have highlighted the importance of diverse energy sources and reliable supply partnerships, influencing investment decisions and trade relationships across the globe.

How AI is Reshaping the Future of Oil and Gas:

Artificial intelligence is transforming the oil and gas industry from traditional operations into smart, predictive, and highly efficient systems that optimize everything from exploration to production and distribution. The AI market in oil and gas is worth USD 5.31 million and is projected to triple to USD 15.01 million by 2029, reflecting the industry's massive digital transformation.

Machine learning and predictive analytics are revolutionizing exploration and drilling operations. AI algorithms analyze vast amounts of seismic data, geological surveys, and historical drilling information to identify optimal drilling locations with unprecedented accuracy. This reduces exploration risks, minimizes dry wells, and significantly improves success rates. Traditional exploration processes that took months are now compressed into weeks through AI-powered analysis and modeling.

Predictive maintenance has become one of the highest value applications of AI in the industry. Advanced algorithms monitor equipment performance in real-time, analyzing sensor data from drilling rigs, pipelines, and refineries to predict equipment failures before they occur. This prevents costly downtime, reduces maintenance costs, and improves safety by identifying potential hazards early. Companies report significant operational improvements as AI systems learn from historical failure patterns and environmental conditions.

Intelligent operations optimization is transforming day-to-day operations across the value chain. AI systems continuously analyze production data, market conditions, and logistical constraints to optimize extraction rates, refining processes, and distribution networks. Real-time monitoring and automated adjustments ensure maximum efficiency while maintaining safety standards. Digital twin technology creates virtual replicas of physical assets, enabling companies to test scenarios and optimize performance without operational risks.

The integration of IoT sensors with AI platforms creates comprehensive monitoring networks that provide unprecedented visibility into operations. These systems track everything from wellhead pressure to pipeline integrity, enabling proactive management and rapid response to changing conditions. The technology is particularly valuable in remote operations where human oversight may be limited.

Buy Now: https://www.imarcgroup.com/checkout?id=12642&method=1670

Segmental Analysis:

Analysis by Type:

- Upstream

- Midstream

- Downstream

The upstream segment represents the largest segment with 49.8% market share. Also known as the exploration and production (E&P) sector, it serves as the cornerstone of the oil and gas industry, consisting of discovery, exploration, and extraction of crude oil and natural gas from underground or underwater reservoirs.

Analysis by Application:

- Offshore

- Onshore

Offshore operations involve exploration and production activities in continental shelf and deep-water ocean areas. While more complex and costly than onshore operations, offshore projects provide access to significant untapped reserves that can yield large volumes of oil and gas, supported by advanced subsea technology and specialized vessels.

Analysis of Oil and Gas Market by Regions

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

Asia Pacific is the largest region in the oil and gas market with 36.8% market share, primarily driven by rapid industrial growth, burgeoning population, and increasing energy demands. China and India lead investments in both upstream and downstream segments, with the region's commitment to securing energy supplies supporting expanding economies through significant exploration activities and LNG development.

What are the Drivers, Restraints, and Key Trends of the Oil and Gas Market?

Market Drivers:

The oil and gas market benefits from several powerful forces driving sustained demand across multiple sectors and geographic regions. Global energy consumption continues to grow as developing economies industrialize and urbanize at unprecedented rates. The transportation sector remains heavily dependent on petroleum products, while industrial processes across manufacturing, petrochemicals, and power generation require substantial oil and gas inputs.

Energy security concerns have become paramount for national governments, driving domestic production investments and diversified supply partnerships. Countries are investing heavily in exploration technologies and infrastructure to reduce dependence on imports and ensure reliable energy access. This trend has accelerated following recent geopolitical tensions and supply chain disruptions that highlighted vulnerability risks.

Natural gas demand is experiencing particularly strong growth as it serves as a transitional fuel in the global energy transition. Countries seeking to reduce carbon emissions while maintaining reliable power generation are turning to natural gas as a cleaner alternative to coal. This has created robust demand for LNG infrastructure and long-term supply contracts, supporting significant investment in production and distribution capacity.

Market Restraints:

Despite strong demand drivers, the oil and gas industry faces significant challenges that could constrain growth and profitability. Environmental regulations continue to tighten globally, with carbon pricing mechanisms, emissions targets, and restrictions on new drilling activities creating operational constraints and increasing compliance costs. Global energy-related CO2 emissions increased by 1.1% in 2023, rising by 410 million tons to a record high of 37.4 billion tons, intensifying regulatory pressure.

Price volatility remains a persistent challenge, affecting investment decisions and project economics. Fluctuating oil and gas prices make long-term planning difficult and can quickly change project profitability calculations. This volatility is driven by geopolitical events, supply disruptions, OPEC decisions, and changing demand patterns that create uncertainty for market participants.

The accelerating shift toward renewable energy sources presents a long-term structural challenge. As solar, wind, and other renewable technologies become more cost-competitive and energy storage improves, the demand outlook for fossil fuels may face pressure. Companies must balance current profitability with future energy transition risks.

Market Key Trends:

The oil and gas industry is experiencing transformative changes driven by technological innovation, environmental pressures, and evolving market dynamics. Digital transformation has become a strategic imperative, with companies investing heavily in AI, IoT, and predictive analytics to optimize operations and reduce costs. The IoT market in oil and gas is projected to reach USD 27.7 billion by 2032, reflecting the industry's commitment to smart operations.

Sustainability initiatives are gaining momentum as companies respond to environmental concerns and investor pressure. Carbon capture and storage (CCS) technologies are being deployed to reduce emissions, while companies diversify into renewable energy projects. This dual approach allows firms to maintain current operations while positioning for the energy transition.

Consolidation through mergers and acquisitions continues to reshape the competitive landscape. Companies are combining resources to achieve operational synergies, reduce costs, and improve market positioning. Major transactions like ConocoPhillips' USD 22.5 billion acquisition of Marathon Oil demonstrate the scale of industry consolidation.

Advanced extraction technologies continue to evolve, with enhanced oil recovery techniques, deepwater drilling capabilities, and unconventional resource development expanding the accessible resource base. These innovations extend the economic life of existing fields while opening new production opportunities.

Leading Players of Oil and Gas Market:

According to IMARC Group's latest analysis, prominent companies shaping the global oil and gas landscape include:

- Bechtel Corporation

- Fluor Corporation

- HD Hyundai Heavy Industries Co., Ltd

- John Wood Group PLC

- KBR Inc.

- Larsen & Toubro Limited

- McDermott

- NMDC Group

- Petrofac Limited

- Saipem SpA (Eni S.p.A.)

- Samsung E&A

- TechnipFMC plc

- Técnicas Reunidas S.A.

- Worley

These leading providers are expanding their footprint through advanced technology integration, sustainability initiatives, strategic consolidation, and digital transformation to meet growing global energy demand while adapting to environmental regulations and energy transition challenges.

Recent News and Developments in Oil and Gas Market:

- May 2024: ConocoPhillips announced a definitive agreement to acquire Marathon Oil Corporation through an all-stock deal valued at USD 22.5 billion, including USD 5.4 billion in net debt. This major consolidation reflects the industry trend toward operational synergies and enhanced market positioning in key U.S. oil-producing regions.

- December 2024: U.S. industrial production rose 0.9% in December, marking significant growth that supports increased energy demand for manufacturing and industrial processes. This industrial expansion drives sustained demand for oil and gas across multiple sectors including petrochemicals and power generation.

- Q4 2023: The European Union reported greenhouse gas emissions of 897 million tons of CO2-equivalents for the fourth quarter, highlighting ongoing environmental challenges that are driving investments in cleaner extraction technologies and carbon capture solutions across the industry.

- 2024: North America dominated the global AI and machine learning in oil and gas market with over 30% market share, driven by widespread adoption of advanced analytics and predictive solutions for operations and decision-making, demonstrating the region's leadership in digital transformation.

- 2023: Saudi Arabia's energy consumption per capita reached 316.3 million Btu per person, reflecting the significant energy demands in major oil-producing regions and supporting continued investment in production capacity and infrastructure development across the Middle East.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=12642&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302