IMARC Group has recently released a new research study titled "Polyester Staple Fiber Market Size, Share, Trends and Forecast by Origin, Product, Application, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

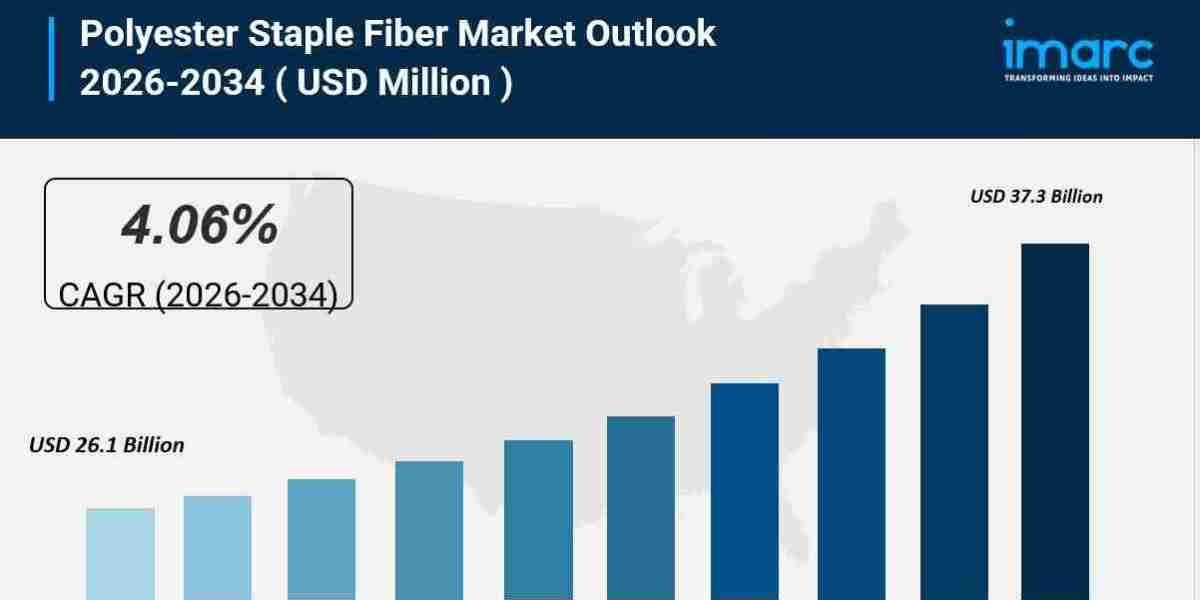

The global polyester staple fiber market was valued at USD 26.1 Billion in 2025 and is projected to reach USD 37.3 Billion by 2034, growing at a CAGR of 4.06% during the forecast period of 2026-2034. Dominated by Asia-Pacific with over 77.6% market share in 2025, the market growth is propelled by rising demand in textiles, non-woven applications, urbanization, and disposable income growth in emerging economies. The polyester staple fiber market benefits from cost and performance advantages over natural fibers and innovations in fiber technology Polyester Staple Fiber Market.

Download a sample PDF of this report: https://www.imarcgroup.com/polyester-staple-fiber-market/requestsample

Study Assumption Years

- Base Year: 2025

- Historical Years: 2020-2025

- Forecast Period: 2026-2034

Polyester Staple Fiber Market Key Takeaways

- Current Market Size: USD 26.1 Billion (2025)

- CAGR: 4.06%

- Forecast Period: 2026-2034

- Asia-Pacific dominates with over 77.6% market share in 2025, driven by textile manufacturing, cost-competitive production, and export-oriented garment industries.

- Virgin polyester staple fiber accounts for around 42.2% share in 2025 due to superior quality and performance.

- Solid polyester staple fiber leads product segment with approximately 64.2% market share in 2025 because of its versatility and strength.

- Apparel is the largest application segment with 45.8% share in 2025, fueled by fast fashion and blended fabric demand.

- The United States accounts for about 82% of North America's market, driven by home furnishing and construction sector growth.

Market Growth Factors

The increasing demand for polyester staple fiber (PSF) is largely fueled by the textile and apparel industry, where its durability, affordability, and versatility are highly valued. The fast-fashion sector, worth USD 185 Billion, heavily relies on PSF due to its cost efficiency and quick production cycles. The rising use of blended fabrics, such as polyester-cotton, and innovations like microfiber and antimicrobial finishes reinforce the fiber's dominance. Additionally, growing disposable incomes and urbanization in emerging economies amplify textile consumption and strengthen PSF demand.

Non-woven applications also contribute significantly to market growth. PSF finds extensive use in automotive industries for interiors, airbags, and sound insulation, as well as in construction where it enhances concrete durability and quality by filling cracks in walls, tiles, blocks, and other materials. The expansion of the real estate sector, especially in regions like India where institutional investments reached USD 8.9 Billion in 2024, drives this demand. Industrial applications in filtration and hygiene products further diversify PSF consumption.

Technological advancements support sustainable growth, with recycling innovations and regulatory alignment fostering eco-friendly PSF production. Although recycled PSF's share has dropped to 12.5% due to technological and cost challenges, corporate sustainability goals and circular economy initiatives encourage adoption. Shifting preferences from natural fibers to synthetic ones, owing to cost and performance benefits, also enhance market prospects. The increase in global synthetic fiber production from 67 million to 75 million tonnes in 2023, with polyester constituting 57%, indicates robust demand continuing into the forecast period.

Request Customization: https://www.imarcgroup.com/request?type=report&id=3869&flag=E

Market Segmentation

By Origin:

- Virgin: Represents around 42.2% of the market in 2025. Known for superior quality, strength, uniformity, and dyeability; preferred in premium apparel, home textiles, and technical fabrics.

- Recycled: Gaining traction due to sustainability trends but currently lower market share compared to virgin.

- Blended: Combination of virgin and recycled fibers, balancing performance and sustainability.

By Product:

- Solid: Holds approximately 64.2% market share in 2025. Features uniform structure, strength, durability, and ease of processing; used widely in textiles, home furnishings, automotive, and filtration.

- Hollow: Alternative product type with distinct structural characteristics; less dominant than solid but growing.

By Application:

- Automotive: Used for roofs, airbags, liners, carpet backing, sound insulation, and safety components; growth linked to light commercial vehicle production.

- Home Furnishing: Applied in carpets, curtains, upholstery; demand driven by home renovation and interior aesthetics.

- Apparel: Leads with 45.8% share in 2025; preferred in fast fashion for durability, cost efficiency, and ability to mimic natural fibers.

- Filtration: Used in industrial and home filtration products.

- Others: Include applications such as speaker felts, geotextiles, wadding, and sound absorption fillers.

Regional Insights

Asia-Pacific is the dominant region, holding over 77.6% of the global polyester staple fiber market share in 2025. This dominance results from strong textile manufacturing, cost-competitive production, rapid urbanization, and government support, especially in China, India, and Vietnam. The region leads in both production and consumption fueled by expanding apparel industries and diversified industrial applications. Continued capacity expansion and technological advancements ensure Asia-Pacific remains the global market leader.

Recent Developments & News

- April 2025: Ganesha Ecosphere invested INR 2 crores in its associate, Ganesha Recycling Chain (GRCPL), enhancing PET waste raw material supply.

- March 2025: Toray Industries, Inc. adopted the mass balance approach for its TORAYLON™ acrylic staple fiber, earning ISCC PLUS certification.

- February 2025: Barmag unveiled sustainable solutions for the Vietnamese textile sector, including the bluesign®-verified Oerlikon Neumag EvoSteam staple fiber process.

- January 2025: SHEIN and Donghua University collaborated on a reusable recycled polyester process, scheduling large-scale production from June 2025.

- January 2025: Ambercycle and Benma partnered to boost polyester fiber circularity, advancing Cycora staple fibers production.

Key Players

- Alpek Polyester

- Bombay Dyeing

- Diyou Fibre (M) Sdn Bhd.

- Huvis Corp.

- Indorama Corporation

- Reliance Industries Limited

- Thai Polyester Co., Ltd

- Toray Industries, Inc.

- Vnpolyfiber

- William Barnet and Son, LLC

- Xin Da Spinning Technology Sdn. Bhd.

Customization Note:

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Ask An Analyst: https://www.imarcgroup.com/request?type=report&id=3869&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302