Mexico Electric Vehicle Charging Station Market Overview

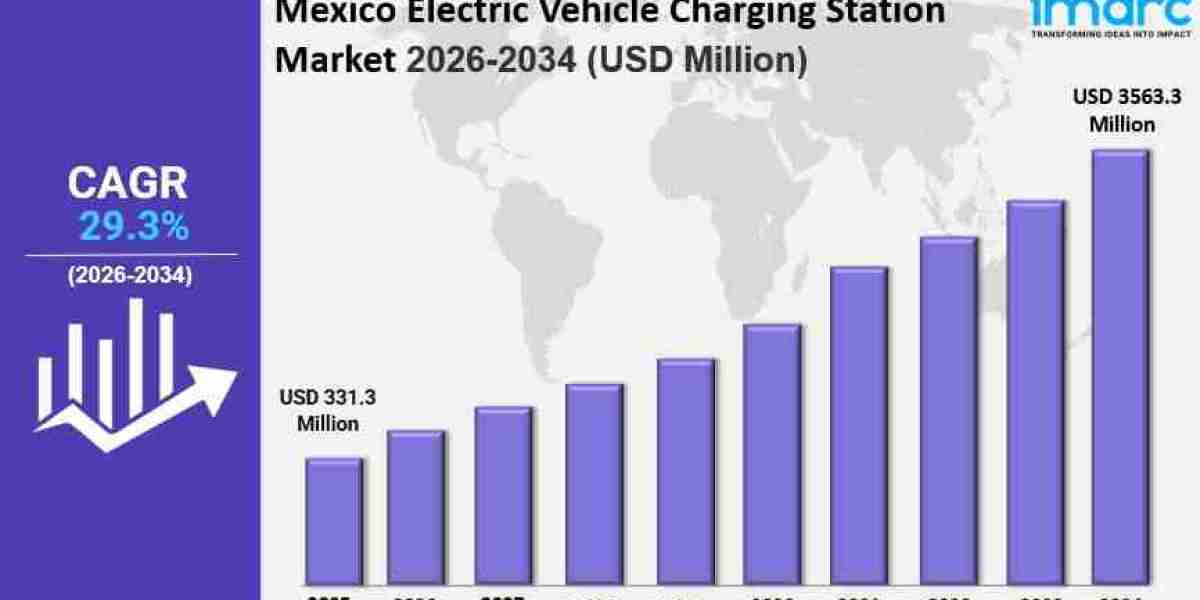

The Mexico electric vehicle charging station market size reached USD 331.3 Million in 2025 and is expected to surge to USD 3,563.3 Million by 2034. The market is projected to grow at a CAGR of 29.3% during the forecast period 2026-2034. Growth drivers include government incentives, increasing EV adoption, rising fuel prices, air quality concerns, and private sector investments, supported by technological advances and alignment with global decarbonization efforts.

For Analysis: IMARCs report provides a deep dive into the Mexico electric vehicle charging station market analysis, outlining the current trends, underlying market demand, and growth trajectories.

Study Assumption Years

- Base Year: 2025

- Historical Year/Period: 2020-2025

- Forecast Year/Period: 2026-2034

Mexico Electric Vehicle Charging Station Market Key Takeaways

- The market size was USD 331.3 Million in 2025.

- The projected CAGR during 2026-2034 is 29.3%.

- The forecast period spans 2026 to 2034.

- EV and PHEV sales in Mexico surged by 83.8% in 2024, reaching 69,713 units.

- Plug-in hybrid sales grew by 154.7% to 38,420 units, surpassing BEVs at 31,293 units.

- Private companies are increasingly investing in charging infrastructure, often partnering with automakers and energy providers.

- Renewable energy, especially solar power integration, is becoming a key feature in charging station design.

- Partnerships like VEMO and Siemens plan to install 500 EV charging points by the end of 2024.

Request a Sample Report with Latest 2026 Data & Forecasts: https://www.imarcgroup.com/mexico-electric-vehicle-charging-station-market/requestsample

Mexico Electric Vehicle Charging Station Market Growth Factors

The Mexico electric vehicle charging station market is propelled by robust growth in electric and plug-in hybrid electric vehicle sales. In 2024, EV and PHEV sales rose by 83.8%, totaling 69,713 units. Notably, plug-in hybrids experienced a 154.7% increase to 38,420 units, exceeding fully electric vehicle sales which stood at 31,293 units. This shift indicates evolving consumer preferences and escalates demand for diverse and accessible charging solutions, especially scalable fast-charging networks at urban and intercity locations.

Private sector involvement has expanded substantially, introducing a mixed-ownership model for EV infrastructure. Corporations are investing in urban and highway charging networks often in collaboration with automakers or energy providers. This has intensified competition, improved service quality, and widened station distribution. Retail and commercial establishments increasingly integrate charging as amenities, supporting sustainable branding. Foreign providers bring advanced technologies and expertise, augmenting infrastructure outreach, particularly in areas underserved by public networks.

Integration of renewable energy, primarily solar power, is a significant growth driver. Mexico's strong solar potential enables operators to deploy photovoltaic systems for powering charging stations, reducing grid dependence and operational costs. Some installations incorporate energy storage to stabilize supply during peak demands or outages. Additionally, renewable-powered charging points often qualify for government incentives and international funding, aligning economic viability with environmental responsibility. Notable partnerships like VEMO and Siemens aim to install 500 charging points with 160kW fast chargers on key highways, underpinning commitments to reduce carbon emissions and enhance sustainable urban mobility.

Mexico Electric Vehicle Charging Station Market Segmentation

Charging Station Type:

- AC Charging: Stations providing alternating current charging suitable for various EVs.

- DC Charging: Stations offering direct current charging for faster vehicle replenishment.

- Inductive Charging: Wireless charging stations enabling non-contact electrical energy transfer.

Vehicle Type:

- Battery Electric Vehicle (BEV): Vehicles powered exclusively by electric batteries.

- Plug-in Hybrid Electric Vehicle (PHEV): Vehicles combining internal combustion engines with electric batteries rechargeable from external sources.

- Hybrid Electric Vehicle (HEV): Vehicles featuring both combustion engine and electric motor without external charging.

Installation Type:

- Portable Charger: Mobile charging units suitable for flexible placement and easy transport.

- Fixed Charger: Stationary charging units permanently installed at specific locations.

Charging Level:

- Level 1: Basic charging using standard electrical outlets.

- Level 2: Enhanced charging with higher voltage and faster delivery.

- Level 3: High-speed charging enabling rapid battery replenishment.

Connector Type:

- Combines Charging Station (CCS): Combined AC/DC fast charging connectors standard.

- CHAdeMO: Fast charging connector protocol for electric vehicles.

- Normal Charging: Standard connectors for usual charge requirements.

- Tesla Supercharger: Proprietary high-speed charging connectors for Tesla vehicles.

- Type-2 (IEC 621196): European standard charging connectors.

- Others: Additional connector types not categorized above.

Application:

- Residential: Charging stations designed for private home use.

- Commercial: Charging infrastructure installed in business or commercial environments.

Region:

- Northern Mexico

- Central Mexico

- Southern Mexico

- Others

Regional Insights

The report identifies Northern Mexico, Central Mexico, and Southern Mexico as major regional markets but does not provide specific statistics or market share values for these regions in the source. Therefore, comprehensive regional dominance or statistical insights are not provided in the source.

Recent Developments & News

In February 2025, City Energy and Grupo Solarever inaugurated Mexico City's first EV charging station in Iztacalco, equipped with 10 fast DC chargers of 30-kW and 60-kW capacity, servicing up to 180 electric vehicles daily at a 65% usage rate. These chargers support GBT connectors enhancing compatibility and convenience.

In August 2024, BMW Group Mexico partnered with VEMO to install 144 EV chargers at over 20 premium sites including malls, hotels, and offices. This is part of a broader 024,000 investment including 251 chargers across Latin America. BMW supports EV adoption linking customers to VEMO's network of 500+ chargers plus 33,000+ private chargers in homes and offices.

Key Players

- GAC

- Vemo

- Siemens

- City Energy

- Grupo Solarever

- BMW Group Mexico

Customization Note

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

Speak To An Analyst: https://www.imarcgroup.com/request?type=report&id=31948&flag=C

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Key Highlights of the Report

1. Market Performance (2020-2025)

2. Market Outlook (2026-2034)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The firm offers comprehensive services for market entry and market expansion.

IMARC’s services include thorough market assessments, feasibility studies, company formation assistance, factory setup support, regulatory approvals and license navigation, branding, marketing and sales strategies, competitive landscape and benchmark analysis, pricing and cost studies, and sourcing studies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302