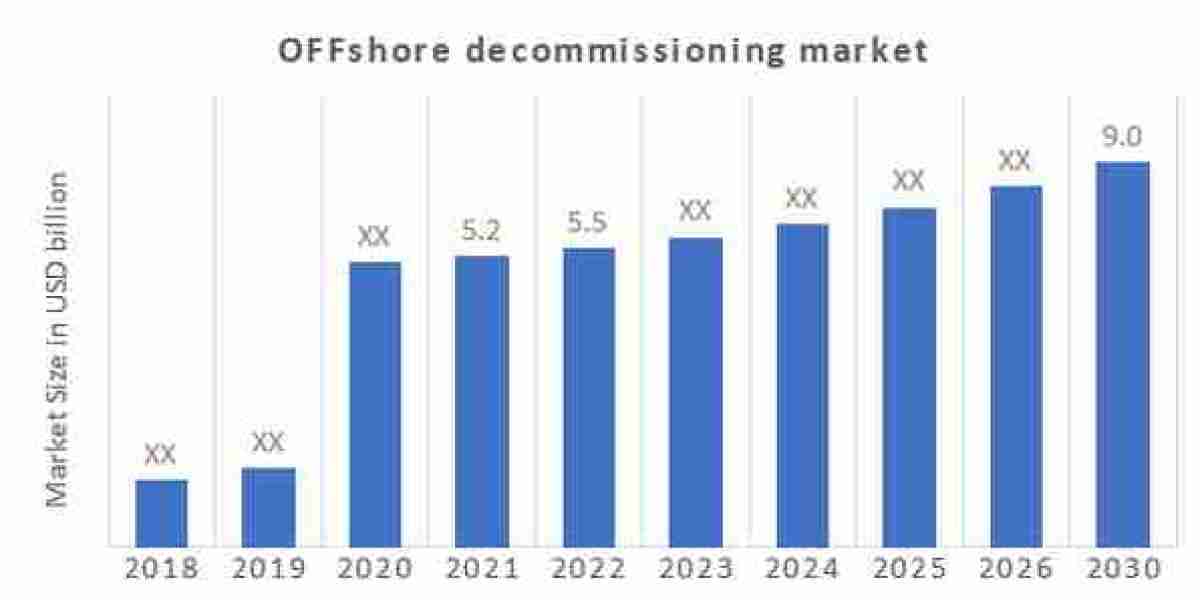

The offshore decommissioning market is on an upward trajectory, with projections estimating a growth from USD 5.2 billion in 2021 to USD 9.0 billion by 2030, reflecting a Compound Annual Growth Rate (CAGR) of 7.10% during the forecast period from 2024 to 2030. This expansion is driven by the maturation of offshore oil and gas fields, stringent environmental regulations, and significant technological innovations.

Market Dynamics and Growth Drivers

The primary catalyst for the market's growth is the increasing number of aging offshore platforms, particularly in regions like the North Sea and the Gulf of Mexico. These areas are witnessing a surge in decommissioning activities as operators seek to retire outdated infrastructure in compliance with evolving environmental standards.

Request for free PDF sample: https://www.marketresearchfuture.com/reports/offshore-decommissioning-market-2993

Key factors contributing to the market's expansion include:

- Regulatory Pressures: Governments worldwide are enforcing stricter decommissioning regulations to mitigate environmental risks associated with abandoned offshore structures. For instance, the U.S. Bureau of Ocean Energy Management has implemented rules requiring operators to secure financial assurances for decommissioning activities.

- Technological Advancements: Innovations such as Artificial Intelligence (AI), Remote Operated Vehicles (ROVs), and advanced cutting techniques are revolutionizing decommissioning processes. AI technologies, for example, have demonstrated the potential to reduce decommissioning costs by up to 35% in regions like the North Sea.

- Environmental Considerations: The adoption of sustainable practices, including the "Rigs-to-Reefs" program, is gaining momentum. This initiative involves converting decommissioned offshore platforms into artificial reefs, promoting marine biodiversity and reducing the ecological footprint of decommissioning activities.

Regional Insights

- North America: The United States, particularly the Gulf of Mexico, leads in decommissioning activities, with numerous platforms reaching the end of their operational life. The implementation of the Rigs-to-Reefs program has been instrumental in managing decommissioning costs and promoting environmental sustainability.

- Europe: The North Sea region is experiencing significant decommissioning efforts, with over 950,000 tons of topside structures scheduled for removal. The UK alone is projected to spend approximately EUR 15.3 billion on decommissioning over the next decade.

- Asia-Pacific: Countries like India, China, and Australia are witnessing a surge in offshore oil and gas activities, leading to an increased demand for decommissioning services. The expansion of renewable energy projects in these regions is also contributing to the market's growth.

Challenges and Opportunities

While the offshore decommissioning market presents substantial growth prospects, it is not without challenges. The high costs associated with decommissioning activities, including well plugging and abandonment, platform removal, and subsea decommissioning, pose financial burdens on operators. Additionally, the complexity of deepwater decommissioning projects requires specialized equipment and expertise, further escalating costs.

However, these challenges also present opportunities for innovation and collaboration. The development of cost-effective technologies, such as AI-driven solutions and advanced robotics, is expected to streamline decommissioning processes and reduce expenses. Moreover, partnerships between governments, industry stakeholders, and research institutions can facilitate knowledge sharing and the development of best practices.

Conclusion

The offshore decommissioning market is at a pivotal juncture, with increasing regulatory mandates, technological advancements, and environmental considerations shaping its trajectory. As the industry navigates these dynamics, stakeholders must prioritize sustainable practices, invest in innovation, and collaborate to ensure the efficient and responsible decommissioning of offshore assets.

For more information on the offshore decommissioning market, visit Market Research Future.