IMARC Group, a leading market research company, has recently released a report titled "Tight Gas Market Report by Type (Processed Tight Gas, Unprocessed Tight Gas), Application (Industrial, Power Generation, Residential, Commercial, Transportation), and Region 2025-2033." The study provides a detailed analysis of the industry, including the global tight gas market size, share, growth, trends, and forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Tight Gas Market Highlights:

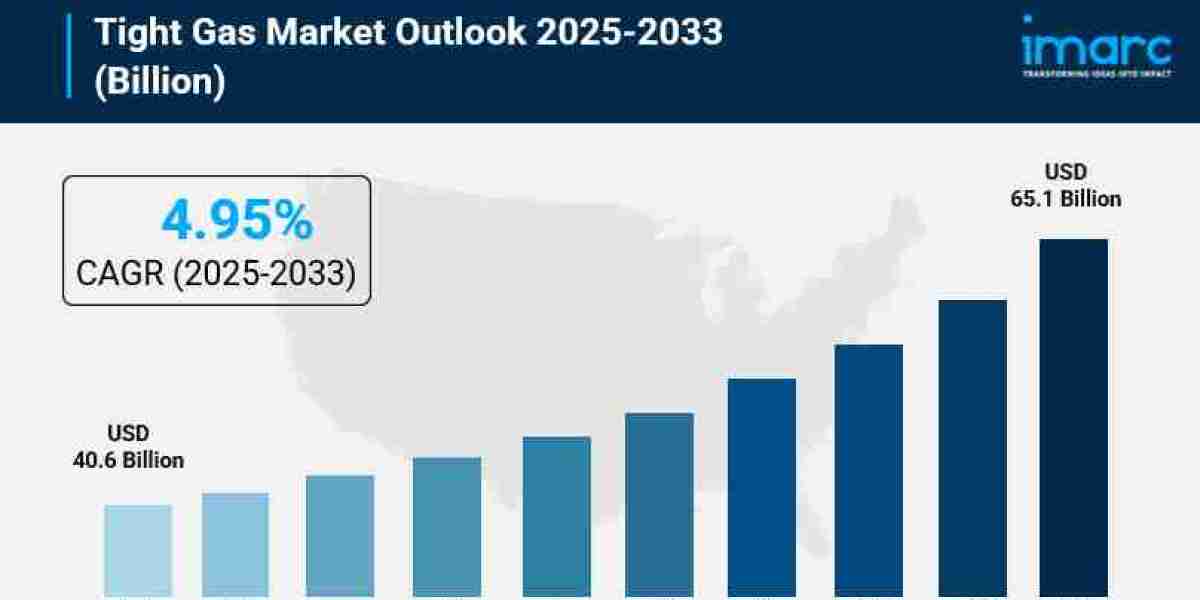

- Tight Gas Market Size: Valued at USD 40.6 Billion in 2024.

- Tight Gas Market Forecast: The market is expected to reach USD 65.1 billion by 2033, exhibiting a growth rate of 4.95% during 2025-2033.

- Production Challenges: Requires advanced extraction techniques like hydraulic fracturing and horizontal drilling.

- Market Growth: Significant increase in production due to technological advancements and rising demand for natural gas.

- Geographical Focus: Major production areas include the United States (e.g., Barnett Shale, Marcellus Shale).

- Environmental Concerns: Issues related to water usage, potential groundwater contamination, and seismic activity from fracking.

- Economic Impact: Contributes to energy independence and job creation, but also impacts local economies and land use.

- Future Trends: Expected to play a crucial role in the transition to cleaner energy sources, with ongoing investments in technology and infrastructure.

Claim Your Free “Tight Gas Market” Insights Sample PDF: https://www.imarcgroup.com/tight-gas-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Technological Advances Reducing Extraction Costs:

Tight gas economics are determined by the costs of developing new and costly technologies for its recovery from rock reservoirs of very low porosity and permeability. The prospects for tight gas are thus directly related to developments in the horizontal drilling and multi-stage hydraulic fracking technologies. These changes have resulted in a large increase in the effective contact area with the productive rock, per well, and rapid production increases over time. Economically-efficient innovation has included increased well density, industrial-scale "pad drilling" (drilling multiple wells in different directions from a single location), and artificial intelligence analysis of the reservoirs to select proper locations for hydraulic fractures. As OPEX and CAPEX required to extract and process the tight gas production directly from these resources continually falls with technological advancements, previously uneconomic tight gas reserves become economic and the tight gas market continues to grow, which increases the competitiveness of tight gas against conventional and other unconventional resources.

- Global Energy Demand and the Gas Transition Role:

Tight gas is closely related to the overall demand for natural gas. Demand for natural gas in the world is on the increase as the world industrializes. Progress in moving away from coal and oil and toward natural gas, which is a relatively lower polluting transitional fuel, is also creating demand. Natural gas burns cleaner with greatly less emission of carbon dioxide and atmospheric pollutants than burning coal for generating electricity and industrial applications. For many Asia Pacific countries, the energy demand is expected to grow at a rapid pace. Tight gas and other forms of unconventional energy sources offer energy security due to their more reliable and diverse availability, which extends the base of domestic energy supply sources, such as in the United States, making them less dependent on energy imports. Because of this calculated importance and its role as a link between high-carbon and renewable energy, market growth projections are strong.

- Regulatory and Environmental Scrutiny on Water and Methane:

One of the main restrictions and drivers of innovation in the tight gas market is increased regulatory and public scrutiny of the environmental impact of hydraulic fracturing. Since tight gas production is very water intensive, flowback and produced water treatment, along with aquifer contamination, are major public concerns. This regulatory pressure has forced the industry to invest heavily to reach compliance, as well as to explore waterless fracturing (by using CO2 or propane gels) and water recycling and water reuse programs. In addition, regulatory expectations in the federal and regional arenas focused on methane emissions (a highly powerful greenhouse gas), from both well sites and transportation and gathering infrastructure are resulting in improved leak detection and repair (LDAR) technologies. The increase in costs is in part a reflection of steps necessary to maintain the industry's social license to operate, and the long term sustainability of tight gas as an energy source.

Tight Gas Market Report Segmentation:

Breakup by Type:

- Processed Tight Gas

- Unprocessed Tight Gas

Breakup by Application:

- Industrial

- Power Generation

- Residential

- Commercial

- Transportation

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Chevron Corporation

- China Petrochemical Corporation

- Equinor ASA

- Exxon Mobil Corporation

- Shell plc

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=11822&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302