Market Overview

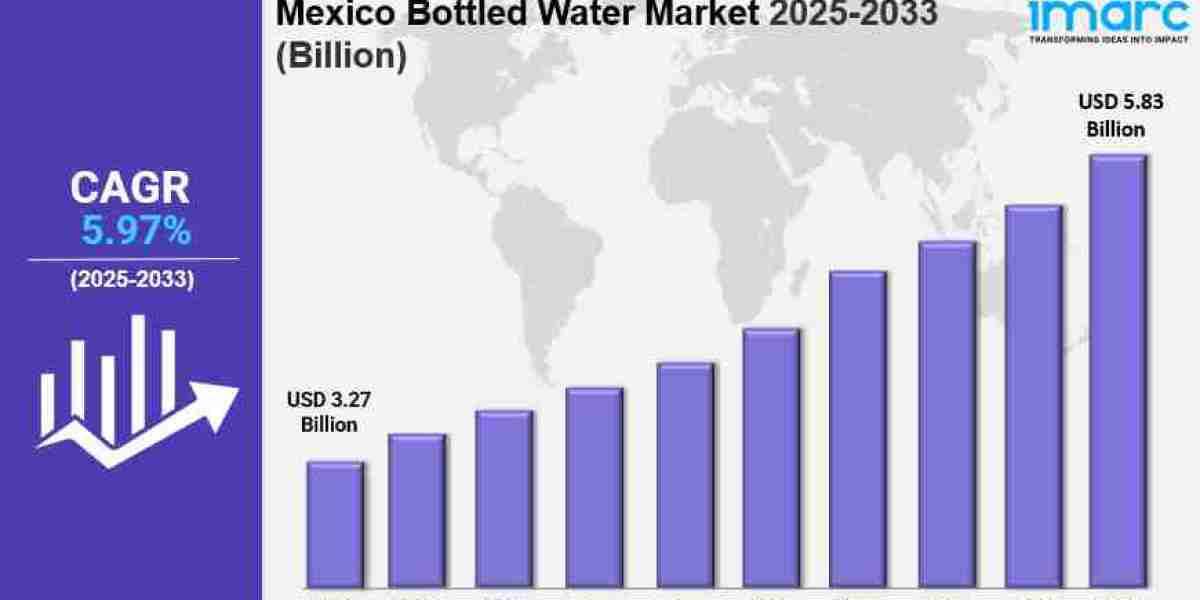

The Mexico bottled water market size reached USD 3.27 Billion in 2024 and is projected to reach USD 5.83 Billion by 2033, growing at a CAGR of 5.97% during 2025-2033. Growth is driven by rising health consciousness, urban development, and better availability of clean water. Consumers prefer branded and purified water over tap options, with premium and flavored variants gaining popularity among younger demographics. Strong competition from local and international players fuels market expansion.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

Mexico Bottled Water Market Key Takeaways

● Current Market Size: USD 3.27 Billion (2024)

● CAGR: 5.97% (2025-2033)

● Forecast Period: 2025-2033

● Rapid urbanization in Mexico is significantly increasing bottled water consumption, with 87.86% of the population living in urban areas as of July 2025.

● Rising disposable incomes enable consumers to prioritize health and wellness by choosing safe, branded bottled water.

● Growing demand for convenience and portability primarily in metropolitan and semi-urban areas boosts market growth.

● The expanding middle class is enhancing market penetration in households and on-the-go consumption.

● Sustainability trends, including use of lightweight bottles and recycled PET, are reshaping packaging, appealing to environmentally conscious consumers.

Sample Request Link: https://www.imarcgroup.com/mexico-bottled-water-market/requestsample

Market Growth Factors

Rapid urbanization and improved disposable incomes have been the driving force for growth for the Mexican bottled water market. In July 2025, the estimated population of Mexico was up to 132 million, with 87.86% in urban areas. Clean water from the tap remains available in few areas consistently, which limits use of that water, increasing demand for safe bottled water in urban areas. People consume bottled water since disposable income rises and health and wellness trends increase. Urban lifestyle along with socio-economic factors impact the markets and competitive landscape.

An additional driver is increasing awareness and preference for branded bottled water with a known quality. Bottled water is generally in high demand among consumers in the metropolitan and semi-urban areas due to its convenience and portability. As the middle-class grows, markets penetrate households and people consume on-the-go more, growing at a 5.97% CAGR from 2025 to 2033.

Sustainability trends have advanced lightweight, recycled and biodegradable packaging throughout the Mexican bottled water sector. Beika founder Roberto Noriega announced he partnered with O-I in December 2024 to produce green glass bottles for the support of their planned eco-friendly bottled water brand in 2025. People know about the environment so lawmakers ban plastic. Companies want to sustain so packaging can sustain more. This preserves materials and moves energy for green consumers.

Mexico Bottled Water Market Segmentation

Product Type Insights:

● Still: Not provided in source.

● Carbonated: Not provided in source.

● Flavored: Not provided in source.

● Mineral: Not provided in source.

These segments represent different types of bottled water available in Mexico catering to varied consumer preferences.

Distribution Channel Insights:

● Supermarkets/Hypermarkets: Not provided in source.

● Convenience Stores: Not provided in source.

● Direct Sales: Not provided in source.

● On-Trade: Not provided in source.

● Others: Not provided in source.

These channels reflect the various ways bottled water is distributed and sold to end consumers.

Packaging Type Insights:

● PET Bottles: Not provided in source.

● Metal Cans: Not provided in source.

● Others: Not provided in source.

Packaging types are crucial for product differentiation and sustainability.

Regional Insights:

● Northern Mexico: Not provided in source.

● Central Mexico: Not provided in source.

● Southern Mexico: Not provided in source.

● Others: Not provided in source.

These regions represent the major geographical segments in the Mexican bottled water market.

Regional Insights

Northern Mexico is identified as one of the key regions in the bottled water market along with Central and Southern Mexico. As of July 2025, about 87.86% of Mexico's population lives in urban areas, creating concentrated demand in metropolitan regions. The regional market analysis covers Northern, Central, Southern, and other parts of Mexico, reflecting diverse consumption and growth patterns.

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=40778&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302