MARKET OVERVIEW

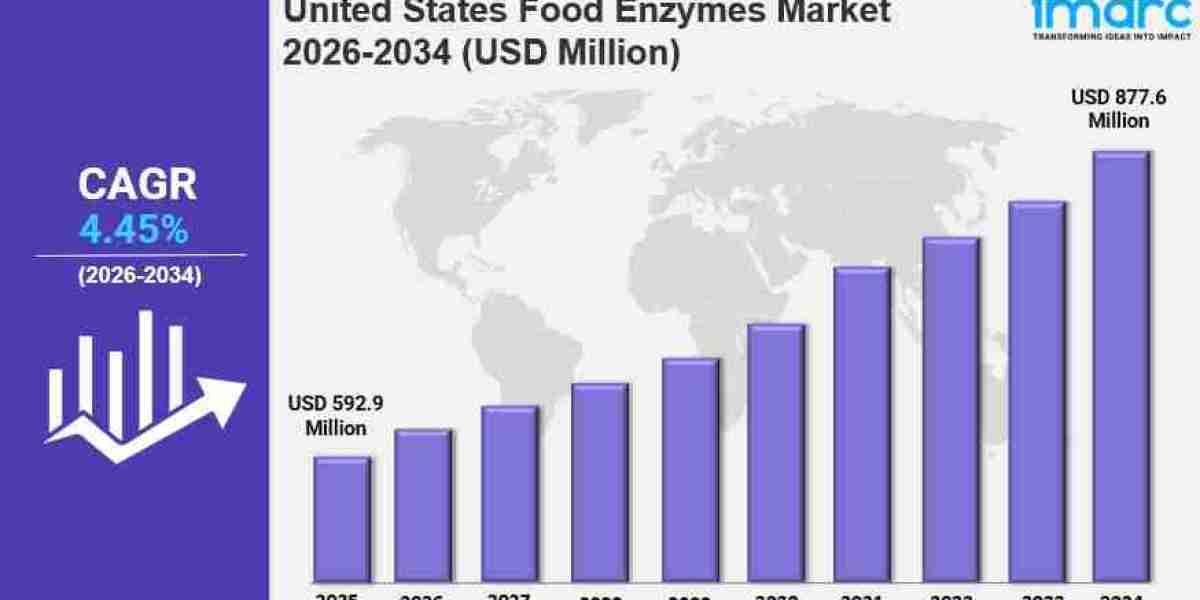

The United States food enzymes market size reached USD 592.9 Million in 2025 and is forecasted to grow to USD 877.6 Million by 2034. The market is expected to expand at a CAGR of 4.45% during the forecast period 2026-2034. This growth is driven by increasing demand for clean-label, functional foods, and the rising incorporation of enzymes in plant-based food processing, offering sustainable and healthy food options.

STUDY ASSUMPTION YEARS

● Base Year: 2025

● Historical Year/Period: 2020-2025

● Forecast Year/Period: 2026-2034

UNITED STATES FOOD ENZYMES MARKET KEY TAKEAWAYS

● Current Market Size: USD 592.9 Million (2025)

● CAGR: 4.45% (2026-2034)

● Forecast Period: 2026-2034

● Demand for clean-label and functional foods, along with growing plant-based and gluten-free diets, is driving the use of natural processing aids.

● Enzyme applications in plant-based food processing and functional drinks are rapidly increasing due to changing consumer preferences for health-oriented and sustainable products.

● Market leaders focus on innovation in enzyme formulations with emphasis on bakery, dairy, and nutraceutical segments.

● Regulatory complexities and formulation limitations present challenges, but demand for personal nutrition and plant alternatives offer significant opportunities.

● Growing health consciousness among consumers promotes functional foods fortified with natural enzymes.

Sample Request Link: https://www.imarcgroup.com/united-states-food-enzymes-market/requestsample

MARKET GROWTH FACTORS

Growing consumer preference for clean-label, natural, and functional food products is significantly boosting United States food enzymes market demand, as buyers increasingly seek simpler ingredient lists and healthier formulation options. This caused a move to eliminate synthetic additives or minimize the use of synthetic additives. Companies have shifted toward using naturally occurring enzymes for texture, shelf life, nutrition, and clean-label compliance. Enzymes utilized throughout baking, dairy, and meat segments continue to see high demand because of the trend toward natural and clean-label products around health and sustainability consciousness.

Functional foods and drinks that health-conscious consumers like have eased how food enzymes combine with protein drinks, plant-based drinks, and dairy alternatives to improve how bioavailable, digestible, and nutritious they are (see bioavailability). Functional benefits of digestive enzymes, including the ability to improve gut health, increase absorption, or digest lactose, are measurable, providing product differentiation that encourages product innovation and market segmentation.

The growing interest in plant foods in the US has also led to a high demand for enzymes capable of improving the flavor, texture, and digestibility of plant proteins, meat analogs, and fermented products. These include enzymes that lower fiber density and bitterness of plant foods, and enzymes with the ability to replace the function of the animal product without disrupting plant structure. Enzymes such as Novozymes' Vertera ProBite for improving texture in plant-based meat are helping to address consumer demand for more ethical and sustainable products, and are establishing themselves as an important ingredient in the growing alternative protein ingredient industry.

MARKET SEGMENTATION

Type:

● Carbohydrase

● Amylase

● Cellulase

● Lactase

● Pectinase

● Others

● Protease

● Lipase

● Others

Source:

● Microorganisms

● Bacteria

● Fungi

● Plants

● Animals

Formulation:

● Powder

● Liquid

● Others

Application:

● Beverages

● Processed Foods

● Dairy Products

● Bakery Products

● Confectionery Products

● Others

Region:

● Northeast

● Midwest

● South

● West

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=2863&flag=C

REGIONAL INSIGHTS

The report segments the United States food enzymes market regionally into Northeast, Midwest, South, and West. The source does not specify which region dominates or provide specific regional market statistics or CAGR values, thus no dominant region or precise data can be stated from the source.

RECENT DEVELOPMENTS & NEWS

In May 2024, Amano Enzyme USA announced an expansion of its Elgin, Illinois plant by adding a 29,827 sq. ft. manufacturing, warehousing, and office space, supporting growth and long-term commitment to specialty enzyme solutions in North, Central, and South America. In June 2023, dsm-firmenich launched Maxilact®Next, a high-purity lactase enzyme that reduces hydrolysis time by 25%, improving efficiency in lactose-free dairy production with higher output and consistent taste, addressing growing global demand without extensive production investment.

KEY PLAYERS

● Amano Enzyme USA

● dsm-firmenich

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302