Market Overview

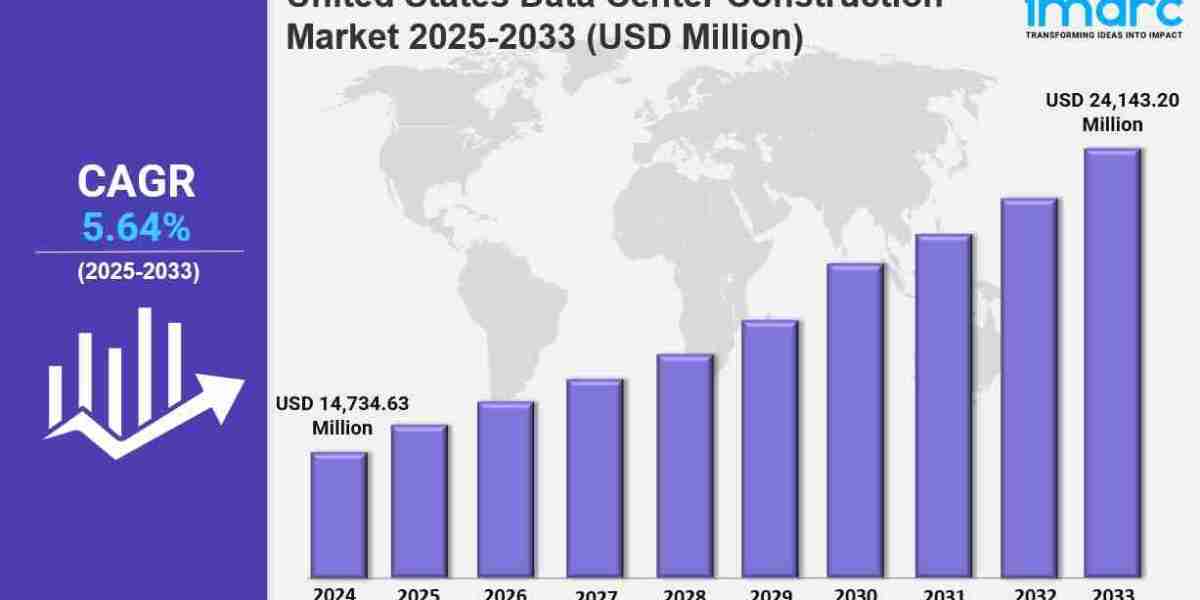

The United States data center construction market size was valued at USD 14,734.63 Million in 2024 and is forecast to reach USD 24,143.20 Million by 2033. The market is expected to grow at a CAGR of 5.64% during 2025-2033. Growth is primarily driven by rising demand for AI, cloud, and hyperscale computing, with key regions like Northern Virginia, Texas, and the Southeast expanding capacity.

Study Assumption Years

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

United States Data Center Construction Market Key Takeaways

● Current Market Size: USD 14,734.63 Million in 2024

● CAGR: 5.64% during 2025-2033

● Forecast Period: 2025-2033

● The market growth is fueled by demand from AI, cloud, and hyperscale computing needs.

● Adoption of edge computing drives the development of decentralized data centers.

● Government policies and renewable energy mandates encourage sustainable construction practices.

● Key regions such as Northern Virginia, Texas, and Phoenix are data center hotspots.

● Major tech firms like Google Cloud, Microsoft Azure, and Amazon Web Services heavily invest in next-generation facilities.

● The rising trend of remote work amplifies demand for scalable and resilient data centers.

Sample Request Link: https://www.imarcgroup.com/united-states-data-center-construction-market/requestsample

Market Growth Factors

The United States data center construction market is propelled by the surging demand for digital infrastructure across sectors. Exponential data generation driven by machine learning, artificial intelligence, IoT, and 5G is pushing hyperscale cloud providers and enterprises to expand their facilities. For example, the Stargate project involves a $100 Billion joint venture investment, building massive data centers to support increasing workloads. This trend directly increases demand for advanced data center construction equipped with high power density and efficient cooling systems.

Edge computing adoption is another significant growth driver, as it requires decentralized data centers closer to end users to reduce latency and enhance performance. Favorable government policies, including tax incentives and renewable energy mandates, further promote sustainable and energy-efficient construction. Organizations in healthcare, banking, and e-commerce are investing heavily in modular and scalable data centers to support increasing IT infrastructure needs.

Additionally, the rapid increase in data consumption and cloud services usage contribute to market expansion. U.S. wireless networks transmitted 100.1 trillion megabytes of data in 2023, up 89% since 2021, underscoring the critical role data centers play. Large cloud providers and hyperscalers are aggressively expanding data center footprints, motivated by needs in AI, big data, and real-time digital services, driving continuous capital investments in scalable, energy-efficient, and reliable data center infrastructures.

Market Segmentation

Analysis by Construction Type:

● Electrical Construction: Dominant segment due to power-intensive demands; involves switchgear, generators, UPS systems, and PDUs ensuring uptime.

● Mechanical Construction: Vital for thermal management; uses advanced HVAC, liquid cooling, and airflow management with a focus on energy efficiency and green designs.

Analysis by Data Center Type:

● Mid-Size Data Centers: Balance scalability and cost; ideal for regional enterprises and edge computing with faster rollout capability.

● Enterprise Data Centers: Maintained by large organizations for security and compliance; support hybrid environments integrating on-premise and public clouds.

● Large Data Centers: Dominated by cloud providers and hyperscalers; support massive data volumes and AI workloads with economies of scale.

Analysis by Tier Standards:

● Tier I and II: Cost-effective for small to mid-sized enterprises; increasingly developed to support localized processing needs.

● Tier III: Preferred for high availability and concurrently maintainable infrastructure; offers 99.982% uptime, widely used across financial services and healthcare.

● Tier IV: Highest fault tolerance and 99.995% uptime; designed for mission-critical operations in defense, government, and hyperscale cloud computing.

Analysis by Vertical:

● Public Sector: Investments driven by digital governance, public services, and national security with demand for secure, compliant data centers.

● Oil and Energy: Digital transformation requiring real-time analytics and edge data centers supporting remote operations.

● Media and Entertainment: High bandwidth needs for streaming, gaming, and content distribution, expanding capacity near urban hubs.

● IT and Telecommunication: Not explicitly detailed in source.

● Banking, Financial Services and Insurance (BFSI): Included as key sectors requiring dedicated infrastructure.

● Healthcare: Significant demand for reliable IT infrastructure.

● Retail: Not explicitly detailed in source.

● Others: Not explicitly detailed in source.

Regional Insights

The Southern US region is dominant in data center construction, led by Texas, Georgia, and Virginia, due to business-friendly regulations, abundant land, and competitive energy pricing. It houses major technology companies and cloud providers and benefits from rapid population growth and urban expansion, increasing data traffic. This region's existing power grids and renewable energy projects enhance its appeal, making it a hotspot for data center construction.

Recent Developments & News

● June 2025: Sika launched smart, durable solutions to support data center construction amid global investments exceeding CHF 400 Billion by 2028.

● June 2025: Amazon announced a $10 Billion data center expansion in North Carolina, contributing to a $100 Billion AI-focused capital plan, creating 500 jobs.

● January 2025: EDGNEX Data Centers by DAMAC revealed a $20 Billion U.S. expansion targeting 2,000MW capacity, with plans to double investment.

● January 2025: Engine No. 1, Chevron, and GE Vernova plan U.S. data centers powered by up to four gigawatts of natural gas, launching by 2027.

● December 2024: Meta announced a $10 Billion AI-optimized data center in northeast Louisiana, employing thousands and utilizing 100% renewable energy.

● October 2024: Microsoft began constructing datacenters using cross-laminated timber to reduce carbon emissions by up to 65%, aligned with its 2030 carbon-negative goal.

Key Players

● Turner Construction

● DPR Construction

● Jacobs Engineering

● Holder Construction

Ask an Analyst: https://www.imarcgroup.com/request?type=report&id=20217&flag=C

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302