United States HIV Drugs Market Size, Share, Trends and Forecast by Drug Class, Distribution Channel, and Region, 2025-2033

MARKET OVERVIEW

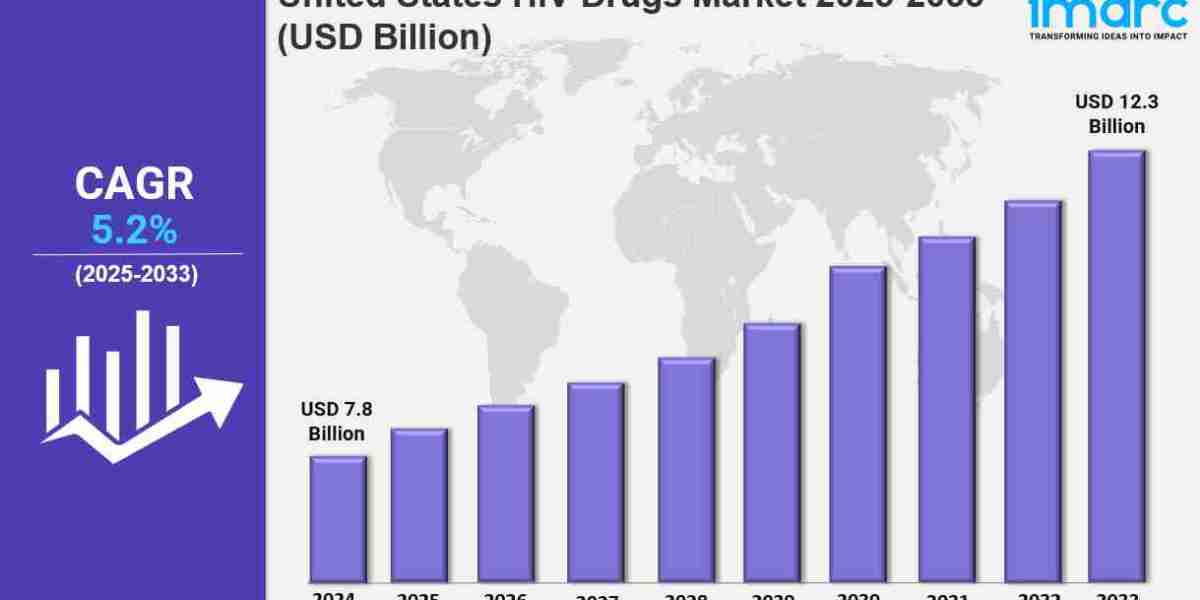

The United States HIV drugs market was valued at USD 7.8 Billion in 2024 and is projected to reach USD 12.3 Billion by 2033, exhibiting a CAGR of 5.2% from 2025 to 2033. The market growth is propelled by advancements in antiretroviral therapy, rising HIV prevalence, increased awareness, early diagnosis initiatives, and supportive government programs. Innovations such as long-acting formulations and combination therapies further enhance treatment adherence and market expansion. Continuous research and rising demand for preventive measures like PrEP are additional growth contributors. For more details, visit the United States HIV Drugs Market (https://www.imarcgroup.com/united-states-hiv-drugs-market).

STUDY ASSUMPTION YEARS

● Base Year: 2024

● Historical Year/Period: 2019-2024

● Forecast Year/Period: 2025-2033

UNITED STATES HIV DRUGS MARKET KEY TAKEAWAYS

● Current Market Size: USD 7.8 Billion in 2024

● CAGR: 5.2% (2025-2033)

● Forecast Period: 2025-2033

● Over 1.1 million Americans were living with HIV in 2024, driving substantial market demand.

● Antiretroviral therapy adoption enables patients to achieve undetectable viral loads.

● Government programs like the Ryan White HIV/AIDS Program and Medicaid expansion support treatment access.

● Public health campaigns have increased early diagnosis and treatment initiation.

● Innovations in treatment, such as fixed-dose combinations and long-acting injectables, enhance adherence and patient convenience.

Sample Request Link: [https://www.imarcgroup.com/united-states-hiv-drugs-market/requestsample]

MARKET GROWTH FACTORS

The growth of the HIV drug market in the US is due to the increased prevalence of HIV. More than 1.1 million people are estimated to be living with HIV in 2024 within the US. For decades, the annual rate of new infections remained around at 50,000. In recent years, new infections have declined because people use evidence-based prevention tools like pre-exposure prophylaxis (PrEP) and HIV treatment as prevention, in order to stop transmission. ART treats, turns the epidemic around, and makes it a chronic and manageable disease.

New drug formulations may make the market expand. Fixed-dose combinations are examples. New forms of injection may make the market expand. Long-acting injections are examples of these. Lenacapavir launched in 2022. It is an antiretroviral injectable drug given every six months. Government-led programs for example the Ryan White HIV/AIDS Program and expansion of Medicaid have improved access to HIV medications for the uninsured and underserved, which has increased demand.

Early diagnosis increased because of routine HIV testing and public awareness campaigns. Using antireTROvirals (ARVs) regularly as pre-exposure prophylaxis (PrEP) lowers the risk that one acquires HIV from sex by over 99%. It lowers the risk among people who inject drugs by 74% or more. Pre-exposure prophylaxis (PrEP) programs easing early diagnosis and testing likewise encourage timely treatment and increase clientele, and in June 2024, Gilead Sciences published data on lenacapavir's efficacy among HIV prevention for cisgender women.

MARKET SEGMENTATION

Analysis by Drug Class:

● Nucleoside Reverse Transcriptase Inhibitors: Backbone of most antiretroviral therapies; effective in halting viral replication; minimal resistance; included in fixed-dose regimens improving adherence.

● Multi-Class Combination Products: Include multiple drug classes in a single regimen; reduce pill burden; enhance adherence and outcomes; dominate the market.

● Protease Inhibitors: Critical for resistant viral suppression; durable against resistance; used in salvage therapies; significant market share.

● HIV Integrase Strand Transfer Inhibitors: Highly effective and well-tolerated; fast viral load reduction; pivotal in first-line regimens; cornerstone of modern therapy.

● Non-Nucleoside Reverse Transcriptase Inhibitors: Potent viral suppression; widely used in combination therapies; cost-effective; large market presence.

● Entry Inhibitors — CCR5 Co-Receptor Antagonist: Block HIV entry; essential for patients with resistance profiles; relevant in targeted therapy.

● Fusion Inhibitors: Prevent virus-host cell fusion; unique mechanism for resistant cases; niche salvage therapy for heavily treatment-experienced patients.

● Others

Analysis by Distribution Channel:

● Hospital Pharmacies: Dispense anti-HIV drugs to newly diagnosed and hospitalized patients; provide counseling and adherence support; reliable for complex therapies; significant market share.

● Retail Pharmacies: Largest availability; access for prescription refills; partnerships with HIV programs and insurance ensure steady availability and affordability; major distribution channel.

● Online Pharmacies: Growing due to convenience, home delivery, and discretion; appeal to privacy-seeking patients; boosted by telemedicine and internet penetration.

● Others

REGIONAL INSIGHTS

The South is the dominant region in the U.S. HIV drugs market, driven by higher HIV prevalence and targeted federal and state initiatives. Efforts to improve access to care, especially among underserved communities, and the growing adoption of preventive therapies like PrEP are key growth factors. Other regions also contribute: the Northeast with its strong healthcare infrastructure and testing programs; the Midwest through awareness campaigns and Medicaid expansion; and the West with progressive policies and advanced medical facilities.

RECENT DEVELOPMENTS & NEWS

In August 2024, the U.S. FDA approved Dovato (dolutegravir/lamivudine) for treating HIV-1 infection in adolescents aged 12 and above weighing at least 25 kg, either as initial therapy or to replace stable regimens in virologically suppressed patients. ViiV Healthcare is a global HIV specialist mainly owned by GSK, with Pfizer and Shionogi as shareholders. Gilead Sciences, Inc. and Merck (referred to as MSD outside U.S. and Canada) revealed results from a Phase 2 trial assessing a combination of islatravir and lenacapavir. Additionally, in November 2024, Gilead Sciences disclosed initial comprehensive results from its Phase 3 PURPOSE 2 trial on lenacapavir for HIV prevention among diverse populations.

KEY PLAYERS

● Gilead Sciences

● ViiV Healthcare

● Merck & Co.

● Janssen Pharmaceuticals

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

ABOUT US

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

CONTACT US

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302