IMARC Group, a leading market research company, has recently released a report titled "Aerospace Insurance Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the global aerospace insurance market share, size, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Aerospace Insurance Market Highlights:

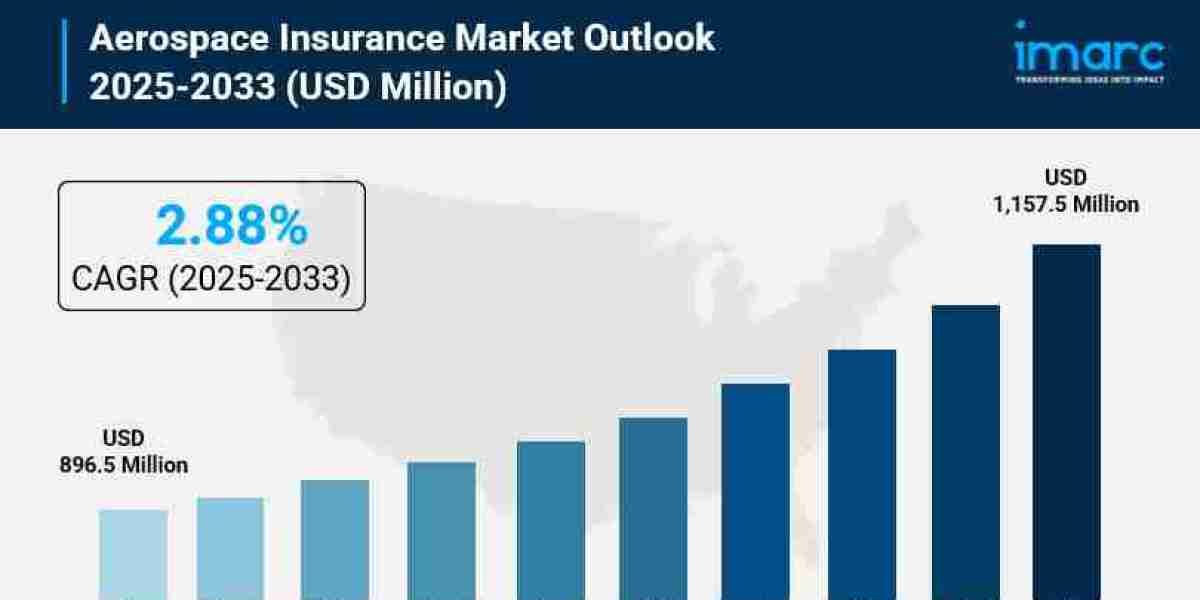

- Aerospace Insurance Market Size: Valued at USD 896.5 Million in 2024.

- Aerospace Insurance Market Forecast: The market is expected to reach USD 1,157.5 Million by 2033, growing at a steady rate of 2.88% annually.

- Market Growth: The aerospace insurance market is experiencing consistent growth driven by expanding commercial aviation operations, rising aircraft fleets, and increasing global air travel demand.

- Technology Integration: Advanced technologies like autonomous aircraft systems, electric propulsion, and digital flight operations are creating new insurance requirements and reshaping risk assessment models.

- Regional Leadership: North America commands the largest market share at 40.0%, fueled by its mature aviation sector, strong regulatory framework, and presence of major aerospace manufacturers.

- Emerging Risks: Rising cybersecurity threats, space exploration activities, and unmanned aerial vehicle (UAV) operations are driving demand for specialized insurance coverage.

- Key Players: Industry leaders include Allianz SE, American International Group Inc., Global Aerospace Inc., Marsh LLC, and Axa S.A., which dominate the market with comprehensive insurance solutions.

- Market Challenges: Evolving risk landscapes including cyber vulnerabilities, climate-related hazards, and integration of new aerospace technologies present ongoing challenges for insurers.

Claim Your Free “Aerospace Insurance Market” Insights Sample PDF: https://www.imarcgroup.com/aerospace-insurance-market/requestsample

Our report includes:

- Market Dynamics

- Market Trends and Market Outlook

- Competitive Analysis

- Industry Segmentation

- Strategic Recommendations

Industry Trends and Drivers:

- Explosive Growth in Air Travel Demand:

The aviation industry is witnessing unprecedented growth, with airports handling record-breaking passenger volumes worldwide. In January 2025, airline traffic in the United States increased by 1.0% compared to January 2024, carrying 60.4 million domestic passengers and 10.4 million international passengers, according to the Bureau of Transportation Statistics. This surge in passenger traffic is creating enormous pressure on airlines to expand their fleets and enhance operational capacity. Modern airlines are investing billions in new aircraft acquisitions, pushing the demand for comprehensive insurance coverage to astronomical heights. Every new aircraft represents a multi-million dollar asset that requires protection against accidents, damage, liability claims, and operational disruptions. The insurance needs extend beyond just hull coverage – airlines need policies that cover passenger liability, cargo operations, ground handling risks, and third-party property damage.

- Revolutionary Technology Integration:

Airports and aviation companies worldwide are embracing cutting-edge technologies that are fundamentally transforming flight operations and aircraft design. The global autonomous aircraft market is anticipated to reach USD 48.34 Billion by 2033, reflecting the massive shift toward automated aviation systems. These advanced aircraft feature sophisticated autopilot systems, complex avionics, and artificial intelligence-driven controls that enhance safety and efficiency. However, these technological leaps also introduce entirely new risk categories that traditional insurance policies weren't designed to address. Cybersecurity vulnerabilities have become a critical concern – in March 2024, Continental Aerospace Technologies, an Alabama-based aircraft engine manufacturer, experienced a severe cyberattack attributed to PLAY ransomware. This incident highlighted the growing exposure of aerospace companies to digital threats. Similarly, the development of electric and hybrid-electric aircraft is creating fresh insurance challenges around battery technology, novel propulsion systems, and untested failure modes. Insurance providers are scrambling to develop specialized products that can adequately cover these emerging technological risks.

- Massive Infrastructure Modernization Projects:

Governments and aviation authorities worldwide are investing heavily in defense capabilities and aerospace infrastructure. India's Union Budget for Financial Year 2025-26 allocated Rs 6.81 lakh crore to the Ministry of Defence, representing a 9.53% increase from the previous year and accounting for 13.45% of the Union Budget. Out of this defense budget, Rs 48,614 Crore was specifically allocated for aircraft and aero engines. These massive investments reflect a global trend of military modernization and acquisition of advanced fighter jets, surveillance drones, and support aircraft. Each of these military aviation programs requires comprehensive insurance coverage that addresses the unique risks of defense operations, including combat exposure, weapons testing, pilot training accidents, and maintenance of highly sophisticated equipment. Beyond military spending, commercial aviation infrastructure is also expanding rapidly. Gulf countries like the UAE and Saudi Arabia are growing their commercial fleets to support tourism and international travel hubs. Between January and July 2024, 17.5 million international tourists visited Saudi Arabia, recording 10% growth compared to the same period in 2023. This tourism boom is driving airport expansions and airline fleet increases, creating sustained demand for aviation insurance products.

- Enhanced Security Requirements Driving Innovation

Global security concerns are fundamentally reshaping aerospace insurance requirements and pushing the industry toward more sophisticated risk management solutions. In October 2024, the International Air Transport Association (IATA) introduced IATA Connect, creating an accredited community of professionals in aviation operations, safety, security, and compliance within airlines, regulatory bodies, and auditors. Members of this network can access the platform to share information securely, exchange safety documents, and collaborate to foster future safety improvements across the aerospace sector. This heightened focus on safety and security is making insurance coverage more complex and comprehensive. Airlines face increasing regulatory scrutiny from aviation authorities like the FAA, EASA, and national civil aviation bodies, all demanding higher standards for operational safety, passenger protection, and environmental compliance. Insurance policies must now cover a broader spectrum of scenarios including terrorism, hijacking, passenger health emergencies, environmental liabilities from fuel spills or emissions, and business interruption from security incidents. The insurance industry is responding by developing layered coverage solutions that address these multifaceted security requirements while keeping premiums manageable for aviation operators.

Aerospace Insurance Market Report Segmentation:

Breakup by Type:

- Life Insurance

- Property Insurance

- Others

Property insurance dominates with 53.2% market share, remaining the preferred choice due to the high value of aerospace assets including aircraft, manufacturing facilities, and supporting infrastructure that require protection against damage, theft, or total loss.

Breakup by Application:

- Service Providers

- Airport Operators

- Others

Airport operators lead with the largest market share, reflecting their broad exposure to operational risks including passenger safety liability, ground handling operations, terminal management, third-party property damage, and business interruption from accidents or natural disasters.

Breakup By Region:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

Who are the key players operating in the industry?

The report covers the major market players including:

- Allianz SE

- American International Group Inc.

- Global Aerospace Inc.

- Hallmark Financial Services Inc.

- Marsh LLC

- China Life Insurance (Overseas) Company Limited

- Travers & Associates

- Malayan Insurance

- Axa S.A.

- ING Group

- Old Republic Aerospace

- Hiscox Ltd.

- Wells Fargo & Company

- Avion Insurance

Ask Analyst For Request Customization: https://www.imarcgroup.com/request?type=report&id=1610&flag=E

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact US:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1–201971–6302